SBI iDeCo: Switching Funds

Posted: Thu Dec 30, 2021 5:44 am

To celebrate my iDeCo reaching ¥1M after investing ¥23k/mo since 2018, I decided to simplify it.

I'm using the select plan. My strategy is "buy the world", and there are two easy ways to do that with SBI:

1. Buy the SBI all world fund

2. Mix and match eMaxis slim funds.

I don't want to do option 1) because the SBI fund is wrapping up US ETFs. Full reasoning is on the wiki: https://retirewiki.jp/wiki/Japanese_global_index_funds

Ideally I would like to buy eMaxis Slim All Country, but it's not available in SBI's iDeCo. So currently my setup is:

eMaxis Slim TOPIX (7%) / eMaxis Slim Emerging Markets (10%)/ eMaxis Slim Developed Markets (83%)

When I set this up, it was slightly cheaper to buy emerging markets / developed markets separately, compared to the eMaxis Slim Whole World (ex-Japan) fund. That's no longer the case, and I don't want to have to think about rebalancing emerging/developed markets, so I'm going to combine them into the whole world fund, making the setup look like:

eMaxis Slim TOPIX 7% / eMaxis Slim Whole World (ex-Japan) 93%

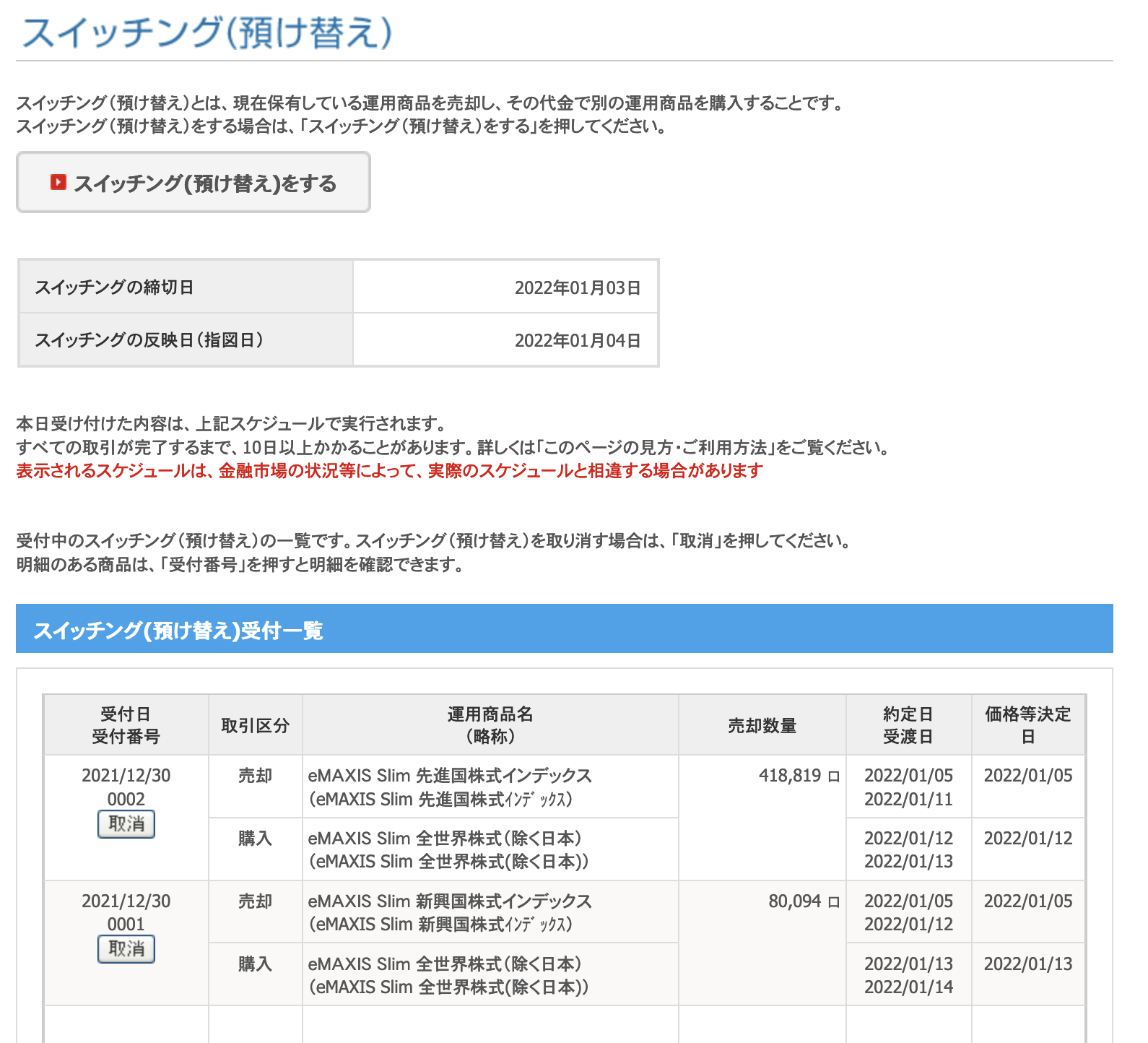

The switcing process was pretty simple. You have to first select a fund to sell, and specify whether you want to sell part of all of your holdings, then select which fund to buy in its place. I chose to sell all of the emerging/developed funds, and for both of them replace them with whole world.

This is how the switching screen looks after applying to switch both funds.

I still have to rebalance Japan, and 7% is maybe slightly overweight, but I think until it gets a few percentage points away from the benchmark it's fine to leave it be.

Now just have to hope the market doesn't shoot up between 5 and 13 January

It would be nice if they didn't wait for the sale to clear before starting the next transaction. It's not like the money is going anywhere else...

I'm using the select plan. My strategy is "buy the world", and there are two easy ways to do that with SBI:

1. Buy the SBI all world fund

2. Mix and match eMaxis slim funds.

I don't want to do option 1) because the SBI fund is wrapping up US ETFs. Full reasoning is on the wiki: https://retirewiki.jp/wiki/Japanese_global_index_funds

Ideally I would like to buy eMaxis Slim All Country, but it's not available in SBI's iDeCo. So currently my setup is:

eMaxis Slim TOPIX (7%) / eMaxis Slim Emerging Markets (10%)/ eMaxis Slim Developed Markets (83%)

When I set this up, it was slightly cheaper to buy emerging markets / developed markets separately, compared to the eMaxis Slim Whole World (ex-Japan) fund. That's no longer the case, and I don't want to have to think about rebalancing emerging/developed markets, so I'm going to combine them into the whole world fund, making the setup look like:

eMaxis Slim TOPIX 7% / eMaxis Slim Whole World (ex-Japan) 93%

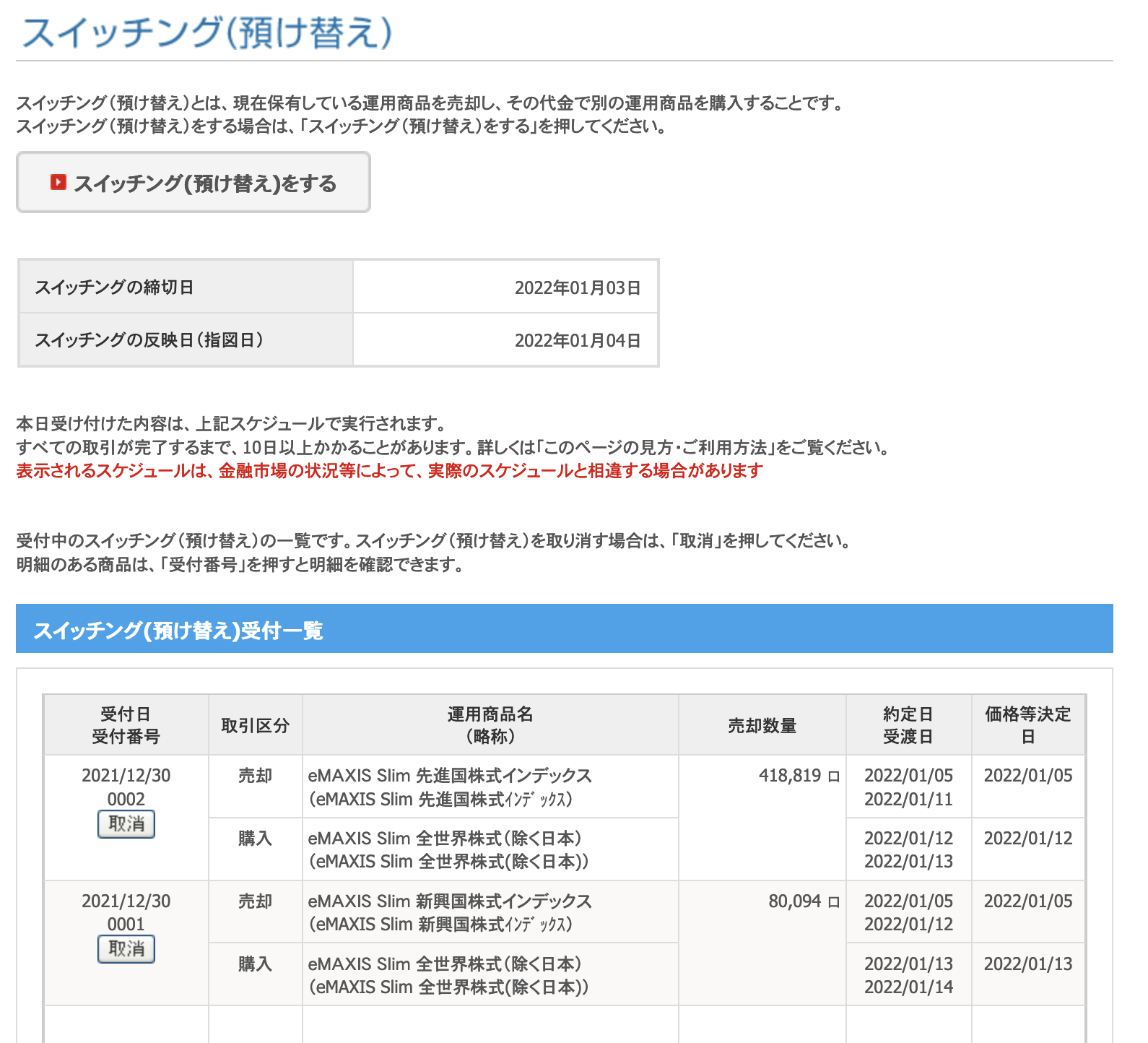

The switcing process was pretty simple. You have to first select a fund to sell, and specify whether you want to sell part of all of your holdings, then select which fund to buy in its place. I chose to sell all of the emerging/developed funds, and for both of them replace them with whole world.

This is how the switching screen looks after applying to switch both funds.

I still have to rebalance Japan, and 7% is maybe slightly overweight, but I think until it gets a few percentage points away from the benchmark it's fine to leave it be.

Now just have to hope the market doesn't shoot up between 5 and 13 January

It would be nice if they didn't wait for the sale to clear before starting the next transaction. It's not like the money is going anywhere else...