I'm using the select plan. My strategy is "buy the world", and there are two easy ways to do that with SBI:

1. Buy the SBI all world fund

2. Mix and match eMaxis slim funds.

I don't want to do option 1) because the SBI fund is wrapping up US ETFs. Full reasoning is on the wiki: https://retirewiki.jp/wiki/Japanese_global_index_funds

Ideally I would like to buy eMaxis Slim All Country, but it's not available in SBI's iDeCo. So currently my setup is:

eMaxis Slim TOPIX (7%) / eMaxis Slim Emerging Markets (10%)/ eMaxis Slim Developed Markets (83%)

When I set this up, it was slightly cheaper to buy emerging markets / developed markets separately, compared to the eMaxis Slim Whole World (ex-Japan) fund. That's no longer the case, and I don't want to have to think about rebalancing emerging/developed markets, so I'm going to combine them into the whole world fund, making the setup look like:

eMaxis Slim TOPIX 7% / eMaxis Slim Whole World (ex-Japan) 93%

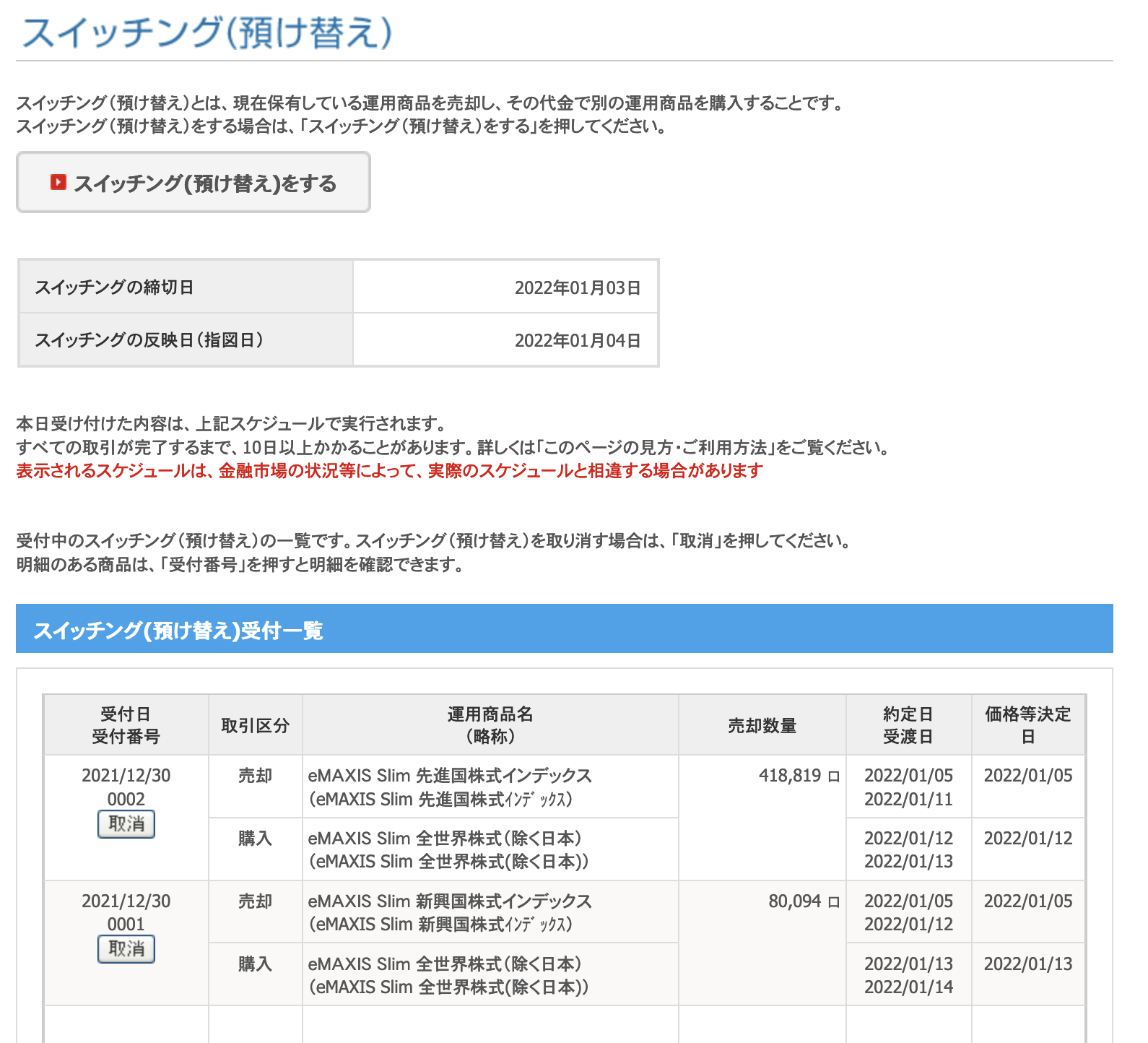

The switcing process was pretty simple. You have to first select a fund to sell, and specify whether you want to sell part of all of your holdings, then select which fund to buy in its place. I chose to sell all of the emerging/developed funds, and for both of them replace them with whole world.

This is how the switching screen looks after applying to switch both funds.

I still have to rebalance Japan, and 7% is maybe slightly overweight, but I think until it gets a few percentage points away from the benchmark it's fine to leave it be.

Now just have to hope the market doesn't shoot up between 5 and 13 January

It would be nice if they didn't wait for the sale to clear before starting the next transaction. It's not like the money is going anywhere else...