Anyways, I just received my tax slip today (令和4年度給与所得等に係る市民税・県民税特別徴収税額の決定通知書) and I have a strange and unpleasant feeling that the actual calculation has given me a value far less than all of the simulators and I've ended up buying things for obscene prices for no reasons.

Before I panic too much, can someone help me learn exactly how to read this?

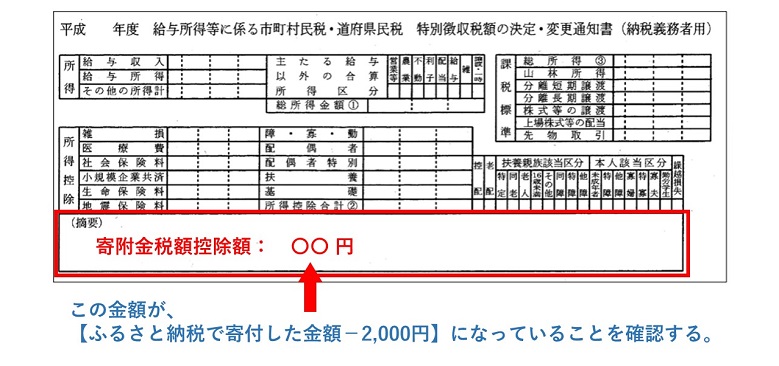

I found this image when searching which gives the very clear idea that the sum of thsoe two values at the bottom are my max furusato amount. Is this true, or is there some additional complication? Because this is far below what I had calculated.

If it makes a difference, I did not do one-stop.

Thanks!