My understanding is that nenmatsu chosei becomes void if you submit a Kakutei Shinkoku so its not a problem. Your wife needs to wait for the gensen choshuhyo 源泉徴収票 that her company will give her around the start of 2022 and then do her Kakutei Shinkoku with the nearest tax agency. This also nullifies the onestop furusato so she would have to add those donations to the form.bryanc wrote: ↑Fri Dec 17, 2021 5:45 am i did mine with onestop and also did nenmatsuchousei.

my wife has submitted nenmatsuchousei at work but she needs to submit the furusato nozei..

as i understand , she cannot do one stop as have medical bills to submit as well for the kakutei shinkoku(400,000yen)

so as I understand she needs to submit a separate kakutei shinkoku with just the medical bills and furusato nozei on it...

or will this be a problem as she has alreadt done nenmatsuchousei at work?

is it ok to submit two separate ones??

Furusato Nozei Experience

Re: Furusato Nozei Experience

Re: Furusato Nozei Experience

For clarification, doing your kakutei shinkoku doesn't "void" nenmatsu chosei, it's more akin to making additions or corrections to the nenmatsu chosei. Items not changed during kakutei shinkoku will remain valid as-is, so you do not need to, say, re-declare a deduction you declared during nenmatsu chosei a second time just because you're submitting medical expenses.

Re: Furusato Nozei Experience

I plugged my estimated 2021 cap gains/distributions/dividends (all overseas) into the Furusato Choice calculator thinking I would be giving myself a nice fat allowance, but it only boosted mine by about ¥20,000.adamu wrote: ↑Thu Oct 28, 2021 10:27 amThis is not correct. Residence tax calculations include miscellaneous income and dividends (when not withheld at source - although I'm not sure of the details).

You can calculate your residence tax here: https://juuminzei.com/keisan/

Does this look right, or am I missing something?

1,800,000 x 5% (residence tax)=90,000 then 20% for Furusato=18,000

Re: Furusato Nozei Experience

Yes, that is correct.

The maximum deductable amount of Purchase Limit for Furusato Nouzei is 20% of the amount of Residential Taxes,

which in turn is 10% of Aggregate Total Taxable Income, so 2% of Total / Marginal Taxable Income from employment, etc.

or

which in turn is 5% of Separate Taxable Capital Gain or Dividend, so 1% of Total / Marginal Capital Gain or Dividend Income

The maximum deductable amount of Purchase Limit for Furusato Nouzei is 20% of the amount of Residential Taxes,

which in turn is 10% of Aggregate Total Taxable Income, so 2% of Total / Marginal Taxable Income from employment, etc.

or

which in turn is 5% of Separate Taxable Capital Gain or Dividend, so 1% of Total / Marginal Capital Gain or Dividend Income

Last edited by Tkydon on Tue Dec 28, 2021 4:31 am, edited 2 times in total.

:

:

This Guide to Japanese Taxes, English and Japanese Tai-Yaku 対訳, is now a little dated:

https://zaik.jp/books/472-4

The Publisher is not planning to publish an update for '24 Tax Season.

:

This Guide to Japanese Taxes, English and Japanese Tai-Yaku 対訳, is now a little dated:

https://zaik.jp/books/472-4

The Publisher is not planning to publish an update for '24 Tax Season.

Re: Furusato Nozei Experience

You've said this a few times, but is it correct? I admit I can't really fathom the calculations, but it seems to be more complicated than that. I also made a similar comment on the wiki: https://retirewiki.jp/wiki/Talk:Furusato_Nozei

Re: Furusato Nozei Experience

I don't really understand the system because my assumption was also that the limit was 20% of what you pay in residential taxes (i.e. 2% of total income) but when I asked my tax accountants to figure the upper limit available to me the figure they quoted was actually just under 4% of my estimated total income with the caveat that once you have made more than 1,500,000 yen in donations and received the equivalent of 500,000 yen worth of thank-you gifts the donations no longer directly offset taxes because you have to account for the gifts received.Tkydon wrote: ↑Thu Dec 23, 2021 2:50 am Yes, that is correct.

The maximum amount of tax credit deductible for Furusato Nouzei is 20% of the amount of Residential Taxes,

which in turn is 10% of Aggregate Total Taxable Income, so 2% of Total Taxable Income from employment, etc.

or

which in turn is 5% of Separate Taxable Capital Gain or Dividend, so 1% of Total Capital Gain or Dividend Income

Re: Furusato Nozei Experience

Yes, it seems to be dependent on your income and residence tax rates, which is dependent on your income. So, I'm not sure there is an easy rule-of-thumb way to calculate it short of plugging in the numbers to a mock tax return / furusato simulator.

Re: Furusato Nozei Experience

The Allowance for Charitable Donation that you can claim as a deduction from your Total Taxable Income is adjusted depending on which Marginal Tax Band you are in, as you would expect, to allow for the higher Marginal National Tax Rate.

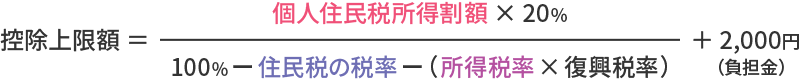

Maximum of 20% of residence tax / (100% - residence tax rate - (income tax rate - reconstruction tax rate)) + ¥2000

The + ¥2000 is fixed, no matter how much allowance you claim, so has no effect on the marginal amount of Allowance for a specific increase in Income.

20% of Residence Tax: This is the Purchase Limit

Residents' Tax Rate of Marginal Aggregate Income is flat rate 10% on Taxable Income under the Aggregate Taxation Method, and 5% on Income such as Capital Gains and Dividends under the Separate Taxation Method, so it would increase the Purchase Limit by:

10% x the 20% limit = 2% of Marginal Aggregate Method Taxable Income

5% x the 20% limit = 1% of Marginal Separate Method Taxable Income such as Capital Gains and Dividends

If you are paying for the Purchase with Post-Tax Income that has had the 10% or 5% Residents' Taxes and the Marginal Income Tax Rate withheld, it is necessary to equalise the Purchase Amount and the Deduction amount to account for these taxes, but not for Gross Income.

You can then divide that by the denominator, to compensate for the Pre-Tax Income.

(100% - residence tax rate - (income tax rate - reconstruction tax rate))

For Aggregate Tax Method Income, the marginal deduction adjustment will be

= 1 - 10% - Marginal Income Tax Rate + Reconstruction Tax Rate

= 1 - 0.1 - X + X*2.1%

So will get smaller as Marginal Income moves from the lower tax brackets to the higher tax brackets, and so the allowance will increase as you would expect to account for the refund of the higher marginal tax rate.

Marginal Tax rate (%)

Under 1,949,000 ― 5%

1,950,000 ― 3,299,000 ― 10%

3,300,000 ― 6,949,000 ― 20%

6,950,000 ― 8,999,000 ― 23%

9,000,000 ― 17,999,000 ― 33%

18,000,000 ― 39,999,000 ― 40%

Over 40,000,000 ― 45%

So for Marginal Aggregate Gross Taxable Income adjustment in each Income Tax Band

= 1 - 0.1 - X + X*2.1%

= 1 - 0.1 - 0.05 + 0.05*0.021 = 0.85105

0.02 / 0.85105 = 0.0235 = 2.35% of Marginal Aggregate Taxable Income

= 1 - 0.1 - 0.1 + 0.01*0.021 = 0.80021

0.02 / 0.80021 = 0.025 = 2.5% of Marginal Aggregate Taxable Income

= 1 - 0.1 - 0.2 + 0.02*0.021 = 0.80021

0.02 / 0.70042 = 0.02855 = 2.855% of Marginal Aggregate Taxable Income

= 1 - 0.1 - 0.23 + 0.023*0.021 = 0.70042

0.02 / 0.670483 = 0.0298 = 3% of Marginal Aggregate Taxable Income

= 1 - 0.1 - 0.3 + 0.03*0.021 = 0.60063

0.02 / 0.60063 = 0.033298 = 3.33% of Marginal Aggregate Taxable Income

= 1 - 0.1 - 0.33 + 0.033*0.021 = 0.570693

0.02 / 0.570693 = 0.035 = 3.5% of Marginal Aggregate Taxable Income

= 1 - 0.1 - 0.4 + 0.04*0.021 = 0.50084

0.02 / 0.50084 = 0.04 = 4% of Marginal Aggregate Taxable Income

and finally for the very top tax band tax payers

= 1 - 0.1 - 0.45 + 0.45*0.021 = 0.45945

= 0.02 / 0.45945 = 0.0435 = 4.35% of Marginal Aggregate Taxable Income

As you would expect to compensate for the higher Tax Band from which the refund is being deducted.

So the deduction increases in line with the increasing Tax Bracket, but the Purchase Limit increases linearly with the gross taxable income.

You can do the same calculations for the adjustment factor for Marginal Income such as Capital Gains, Dividend Income, etc., under the Separate Tax Method.

= 1 - 5% - Marginal Income Tax Rate + Reconstruction Tax Rate

= 1 - 0.05 - 0.05 + 0.05*0.021 = 0.90105

0.02 / 0.90105 = 0.02219 = 2.22% of Marginal Separate Method Taxable Income

etc.

Maximum of 20% of residence tax / (100% - residence tax rate - (income tax rate - reconstruction tax rate)) + ¥2000

The + ¥2000 is fixed, no matter how much allowance you claim, so has no effect on the marginal amount of Allowance for a specific increase in Income.

20% of Residence Tax: This is the Purchase Limit

Residents' Tax Rate of Marginal Aggregate Income is flat rate 10% on Taxable Income under the Aggregate Taxation Method, and 5% on Income such as Capital Gains and Dividends under the Separate Taxation Method, so it would increase the Purchase Limit by:

10% x the 20% limit = 2% of Marginal Aggregate Method Taxable Income

5% x the 20% limit = 1% of Marginal Separate Method Taxable Income such as Capital Gains and Dividends

If you are paying for the Purchase with Post-Tax Income that has had the 10% or 5% Residents' Taxes and the Marginal Income Tax Rate withheld, it is necessary to equalise the Purchase Amount and the Deduction amount to account for these taxes, but not for Gross Income.

You can then divide that by the denominator, to compensate for the Pre-Tax Income.

(100% - residence tax rate - (income tax rate - reconstruction tax rate))

For Aggregate Tax Method Income, the marginal deduction adjustment will be

= 1 - 10% - Marginal Income Tax Rate + Reconstruction Tax Rate

= 1 - 0.1 - X + X*2.1%

So will get smaller as Marginal Income moves from the lower tax brackets to the higher tax brackets, and so the allowance will increase as you would expect to account for the refund of the higher marginal tax rate.

Marginal Tax rate (%)

Under 1,949,000 ― 5%

1,950,000 ― 3,299,000 ― 10%

3,300,000 ― 6,949,000 ― 20%

6,950,000 ― 8,999,000 ― 23%

9,000,000 ― 17,999,000 ― 33%

18,000,000 ― 39,999,000 ― 40%

Over 40,000,000 ― 45%

So for Marginal Aggregate Gross Taxable Income adjustment in each Income Tax Band

= 1 - 0.1 - X + X*2.1%

= 1 - 0.1 - 0.05 + 0.05*0.021 = 0.85105

0.02 / 0.85105 = 0.0235 = 2.35% of Marginal Aggregate Taxable Income

= 1 - 0.1 - 0.1 + 0.01*0.021 = 0.80021

0.02 / 0.80021 = 0.025 = 2.5% of Marginal Aggregate Taxable Income

= 1 - 0.1 - 0.2 + 0.02*0.021 = 0.80021

0.02 / 0.70042 = 0.02855 = 2.855% of Marginal Aggregate Taxable Income

= 1 - 0.1 - 0.23 + 0.023*0.021 = 0.70042

0.02 / 0.670483 = 0.0298 = 3% of Marginal Aggregate Taxable Income

= 1 - 0.1 - 0.3 + 0.03*0.021 = 0.60063

0.02 / 0.60063 = 0.033298 = 3.33% of Marginal Aggregate Taxable Income

= 1 - 0.1 - 0.33 + 0.033*0.021 = 0.570693

0.02 / 0.570693 = 0.035 = 3.5% of Marginal Aggregate Taxable Income

= 1 - 0.1 - 0.4 + 0.04*0.021 = 0.50084

0.02 / 0.50084 = 0.04 = 4% of Marginal Aggregate Taxable Income

and finally for the very top tax band tax payers

= 1 - 0.1 - 0.45 + 0.45*0.021 = 0.45945

= 0.02 / 0.45945 = 0.0435 = 4.35% of Marginal Aggregate Taxable Income

As you would expect to compensate for the higher Tax Band from which the refund is being deducted.

So the deduction increases in line with the increasing Tax Bracket, but the Purchase Limit increases linearly with the gross taxable income.

You can do the same calculations for the adjustment factor for Marginal Income such as Capital Gains, Dividend Income, etc., under the Separate Tax Method.

= 1 - 5% - Marginal Income Tax Rate + Reconstruction Tax Rate

= 1 - 0.05 - 0.05 + 0.05*0.021 = 0.90105

0.02 / 0.90105 = 0.02219 = 2.22% of Marginal Separate Method Taxable Income

etc.

Last edited by Tkydon on Thu Dec 23, 2021 2:46 pm, edited 17 times in total.

:

:

This Guide to Japanese Taxes, English and Japanese Tai-Yaku 対訳, is now a little dated:

https://zaik.jp/books/472-4

The Publisher is not planning to publish an update for '24 Tax Season.

:

This Guide to Japanese Taxes, English and Japanese Tai-Yaku 対訳, is now a little dated:

https://zaik.jp/books/472-4

The Publisher is not planning to publish an update for '24 Tax Season.

Re: Furusato Nozei Experience

Thanks, this finally makes sense to me. So it will be a series sum of each of those % of your income within each bracket. It's an odd example of not just the absolute benefit but also the relative benefit of a tax credit increasing at higher incomes (the with caveat about exceeding 1.5 million in donations).Tkydon wrote:

...

So will get smaller as Marginal Income moves from the lower tax brackets to the higher tax brackets, and so the allowance will increase as you would expect to account for the refund of the higher marginal tax rate.

Marginal Tax rate (%)

Under 1,950,000 ― 5%

1,950,001 ― 3,300,000 ― 10%

3,300,001 ― 6,950,000 ― 20%

6,950,001 ― 9,000,000 ― 23%

9,000,001 ― 18,000,000 ― 33%

18,000,001 ― 40,000,000 ― 40%

Over 40,000,001 ― 45%

So for each Income Tax Band

= 1 - 0.1 - X + X*2.1%

= 1 - 0.1 - 0.05 + 0.05*0.021 = 0.85105

0.02 / 0.85105 = 0.0235 = 2.35% of Marginal Taxable Income

= 1 - 0.1 - 0.1 + 0.01*0.021 = 0.80021

0.02 / 0.80021 = 0.025 = 2.5% of Marginal Taxable Income

= 1 - 0.1 - 0.2 + 0.02*0.021 = 0.80021

0.02 / 0.70042 = 0.02855 = 2.855% of Marginal Taxable Income

= 1 - 0.1 - 0.23 + 0.023*0.021 = 0.670483

0.02 / 0.670483 = 0.0298 = 3% of Marginal Taxable Income

= 1 - 0.1 - 0.3 + 0.03*0.021 = 0.60063

0.02 / 0.60063 = 0.033298 = 3.33% of Marginal Taxable Income

= 1 - 0.1 - 0.33 + 0.033*0.021 = 0.570693

0.02 / 0.570693 = 0.035 = 3.5% of Marginal Taxable Income

= 1 - 0.1 - 0.4 + 0.04*0.021 = 0.50084

0.02 / 0.50084 = 0.04 = 4% of Marginal Taxable Income

and finally for the very top tax band tax payers

= 1 - 0.1 - 0.45 + 0.45*0.021 = 0.45945

= 0.02 / 0.45945 = 0.0435 = 4.35% of Marginal Taxable Income

As you would expect for the marginal income in the higher Tax Bands

Re: Furusato Nozei Experience

Please reread. I have made some edits.

The problem is that Residents' Taxes are derived from a very complex calculation for Taxable Income, after all deductions, and when you take the deduction it feeds back and increases the deductions, reduces the Taxable Income, reduces the National Taxes and Residents' Taxes, and so on.

The OP was asking how much more he could buy if he had some additional expected gross income that he could not guaranty would come in in time in this tax year.

The Marginal Gross Income would increase the Gross Residents' Taxes by 10% for Aggregate Method Taxable Income or 5% for Separate Method Taxable Capital Gain / Dividend Income, so the amount of that Gross Income that could be used for Marginal Furusato Nozei Purchases would be approximately:

Assuming he is at max before the additional income, then he could purchase additional 20% x 10% = 2% or 20% x 5% = 1% of the Additional Gross Income.

A large medical expense deduction could significantly reduce the Residents' Taxes and so significantly reduce the access to the Furusato Nozei Deduction.

The problem is that Residents' Taxes are derived from a very complex calculation for Taxable Income, after all deductions, and when you take the deduction it feeds back and increases the deductions, reduces the Taxable Income, reduces the National Taxes and Residents' Taxes, and so on.

The OP was asking how much more he could buy if he had some additional expected gross income that he could not guaranty would come in in time in this tax year.

The Marginal Gross Income would increase the Gross Residents' Taxes by 10% for Aggregate Method Taxable Income or 5% for Separate Method Taxable Capital Gain / Dividend Income, so the amount of that Gross Income that could be used for Marginal Furusato Nozei Purchases would be approximately:

Assuming he is at max before the additional income, then he could purchase additional 20% x 10% = 2% or 20% x 5% = 1% of the Additional Gross Income.

That's ¥20,000 / ¥1,800,000 = 1.11%TJKansai wrote: ↑Wed Dec 22, 2021 12:10 pm I plugged my estimated 2021 cap gains/distributions/dividends (all overseas) into the Furusato Choice calculator thinking I would be giving myself a nice fat allowance, but it only boosted mine by about ¥20,000.

Does this look right, or am I missing something?

1,800,000 x 5% (residence tax)=90,000 then 20% for Furusato=18,000

A large medical expense deduction could significantly reduce the Residents' Taxes and so significantly reduce the access to the Furusato Nozei Deduction.

:

:

This Guide to Japanese Taxes, English and Japanese Tai-Yaku 対訳, is now a little dated:

https://zaik.jp/books/472-4

The Publisher is not planning to publish an update for '24 Tax Season.

:

This Guide to Japanese Taxes, English and Japanese Tai-Yaku 対訳, is now a little dated:

https://zaik.jp/books/472-4

The Publisher is not planning to publish an update for '24 Tax Season.