Page 1 of 1

iFree ETF JPX Prime 150 for Japan exposure tilt?

Posted: Wed Jul 10, 2024 10:19 am

by ChapInTokyo

I was thinking of adding some Japan tilt to a core portfolio of VT+BNDW with either a Topix or Nikkei 225 ETF but came upon this ”

iFree ETF JPX Prime 150” which was launched earlier this year to track the JPX Prime 150 index.

This looks like a Topix without the zombie companies and so a good way to get exposure to Japan. Thoughts?

Here’s a description of the ETF on the FIA website:

https://www.fiajapan.org/post/first-etf ... dex-listed

“ JPX Prime 150 Index has three major characteristics:

1)Composed of “companies of similar quality to S&P 500”

2) Centered on leading Japanese companies with market capitalization of over JPY 1 trillion, covering about 50% of the Japanese market with 150 stocks

3) Characteristics and performance that are different than TOPIX (large size, high growth potential)

Immediately after commencement of index calculation, the new Index has been underperforming when compared to TOPIX, but the gap has been recently narrowing. The Index has growth characteristics, and the underperformance so far is considered to be mainly due to US interest rate increases in 2023, which have negatively impacted growth stocks, as well as the improvement of value stocks with low PBR following TSE’s request.“

Re: iFree ETF JPX Prime 150 for Japan exposure tilt?

Posted: Wed Jul 10, 2024 11:37 am

by Tsumitate Wrestler

It is an immature index, without much diversity. Topix would be the better choice.

The Prime Index seems more a marketing stunt for JPX, lots of grand hopes, little hard data.

https://jp.reuters.com/article/world/150-idUSKBN2YJ0I3/

Re: iFree ETF JPX Prime 150 for Japan exposure tilt?

Posted: Thu Jul 11, 2024 10:36 am

by ChapInTokyo

I saw the editorial about how JPX is going to root out the zombie companies from TOPIX in yesterday's Nikkei and thought that once they've slimmed the index down to half the number of companies, this will be a much stronger index.

In the meantime though, with BoJ stopping their support of TOPIX prices as they wind down their QE operations, I was thinking that this new JPX Prime150 or even the Nikkei 225 might be a better bet for the mid term. Might be wrong of course, but I aleady have the wider Japanese market coverage according to world cap weighting in my core VT holding, so the additional skew for Japan is a satellite holding for me.

Nikkei Editorial: "The New TOPIX" Will Boost Corporate Reform (July 10 2024)

https://www.nikkei.com/article/DGXZQODK ... 0C2000000/

The Japan Exchange Group (JPX) is reviewing the TSE TOPIX, one of Japan's leading stock price indexes. The plan is to reduce the number of constituent stocks from approximately 2,200 in April 2022 to approximately 1,200 by July 2028, based on market capitalization based on floating shareholdings excluding policy holdings and other factors.

Adoption or exclusion from stock price indexes that attract investors' attention could put strong market pressure on companies to increase their value. In the current stock market, the market capitalization of the prime market has reached 1,000 trillion yen for the first time due to expectations for the transformation of Japanese companies. We hope that the "New TOPIX" will help to spur market-initiated reforms.

In the past, TOPIX was composed of all stocks listed on the First Section of the former Tokyo Stock Exchange. No matter how small a company's market capitalization was, if it was listed on the First Section, it was eligible for investment in mutual funds whose performance was linked to TOPIX.

As a result, discipline loosened after listing on the First Section, and some companies appeared to be slacking in their management efforts; if the TOPIX issues are narrowed down, companies will be forced to change their lukewarm attitude.

Translated with DeepL.com (free version)

Re: iFree ETF JPX Prime 150 for Japan exposure tilt?

Posted: Fri Jul 12, 2024 12:40 am

by Tsumitate Wrestler

I see no compelling reason for a tilt.

Countries like Canada offer quite lucrative tax incentives that make overweighting domestic stocks a sound strategy, it would take this sort of initiative before I would ever consider it.

The rise in interest rates that the BOJ has been loudly forecasting for later this year may shake some trees, these zombie companies are sustained by low-interest debt. A small increase in their payment may push some of them over the brink.

JPX is desperately trying to raise standards to forestall this inevitable issue.

Re: iFree ETF JPX Prime 150 for Japan exposure tilt?

Posted: Sat Jul 13, 2024 12:21 am

by ChapInTokyo

Fair enough.

A tilt makes sense for me because I am retired and wish to increase yen denominated holding in my portfolio to reduce exchange rate risk.

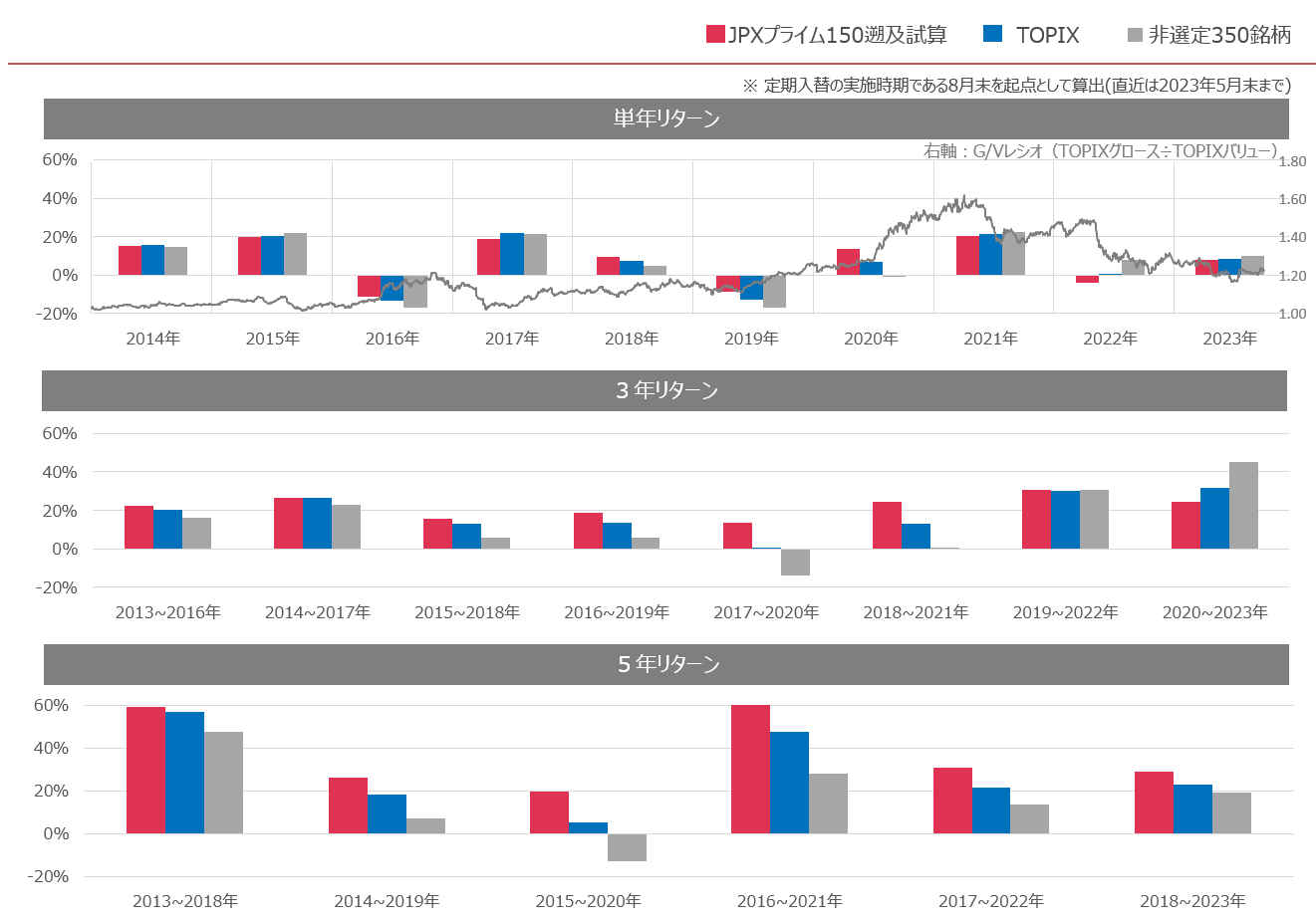

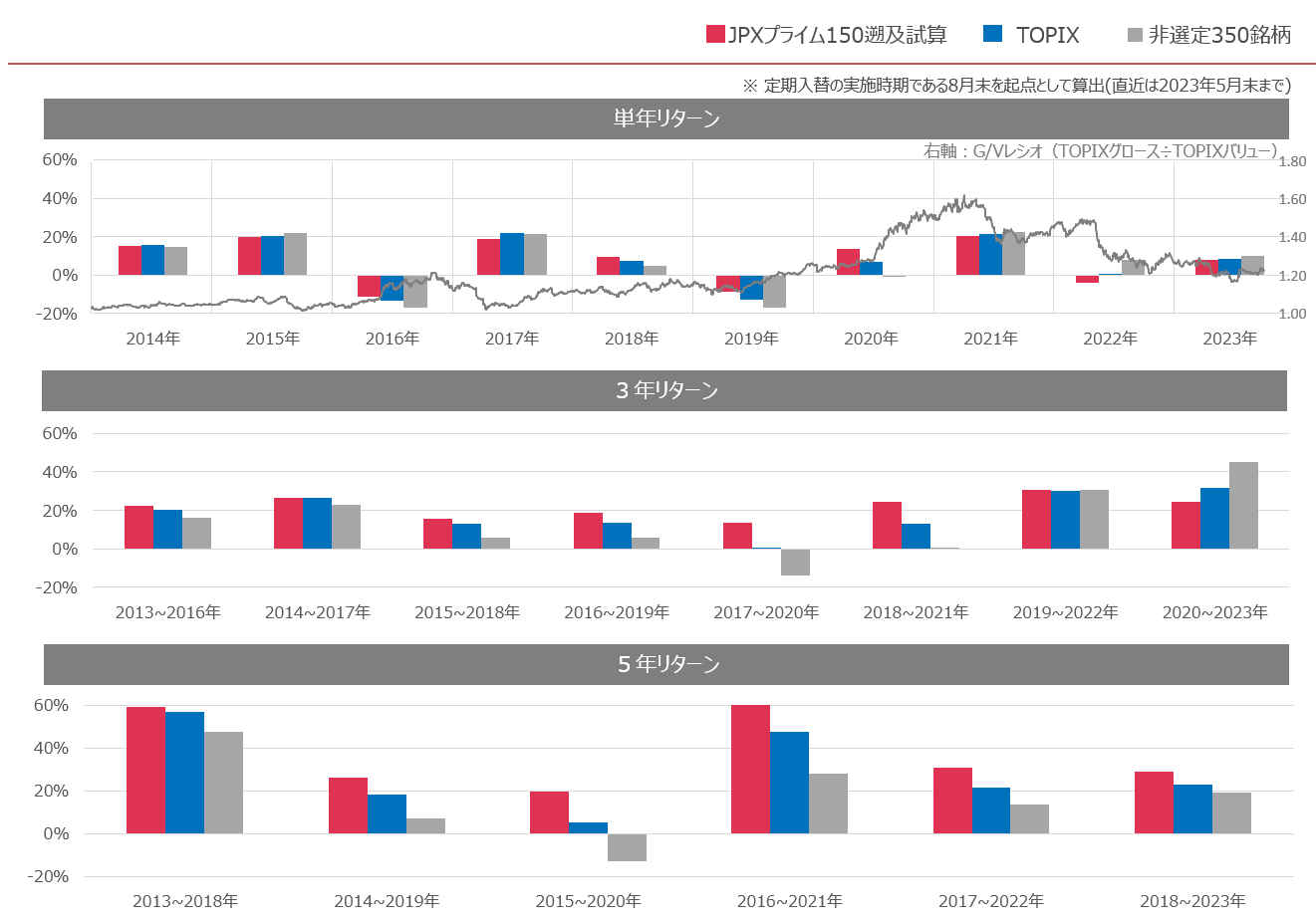

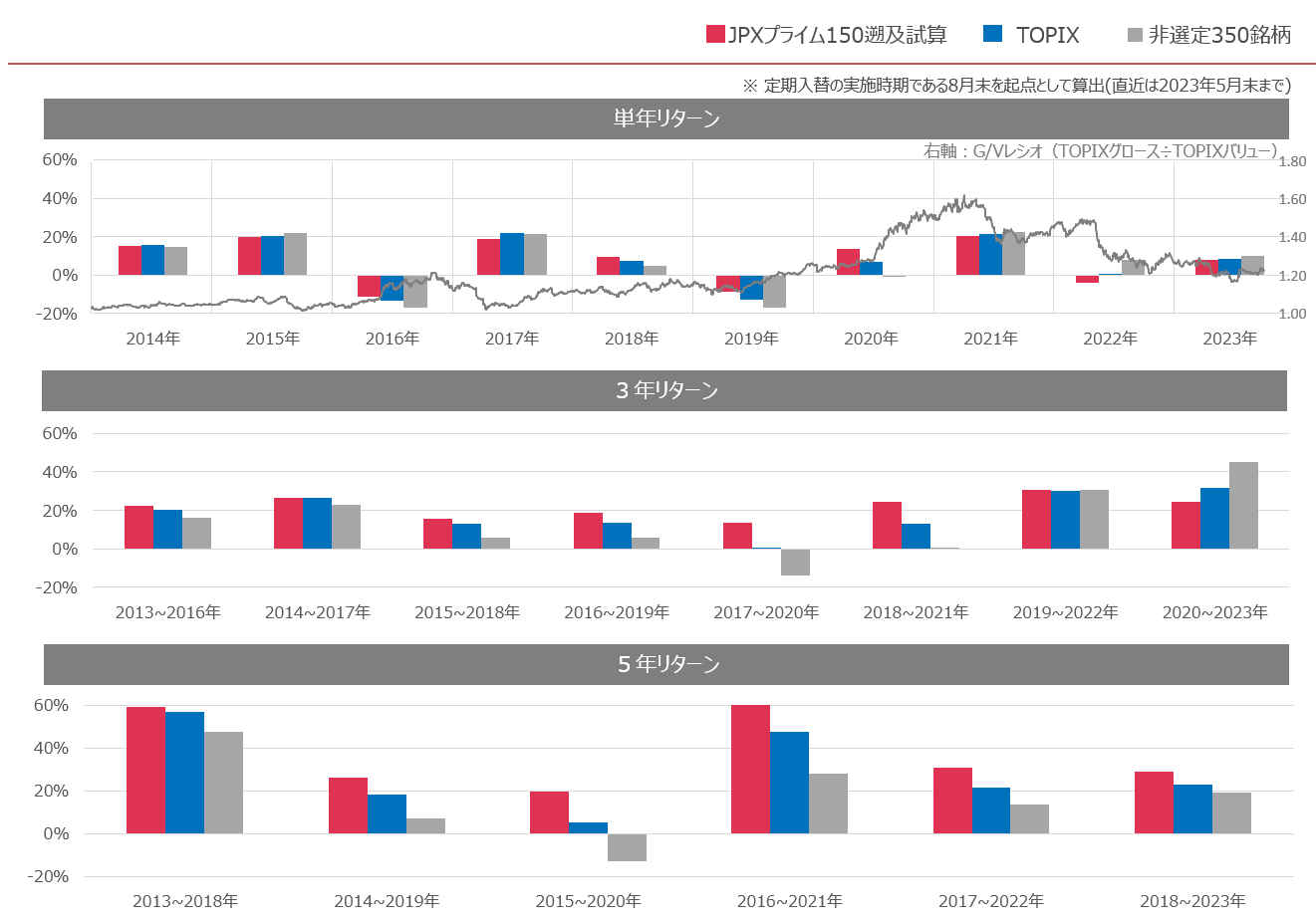

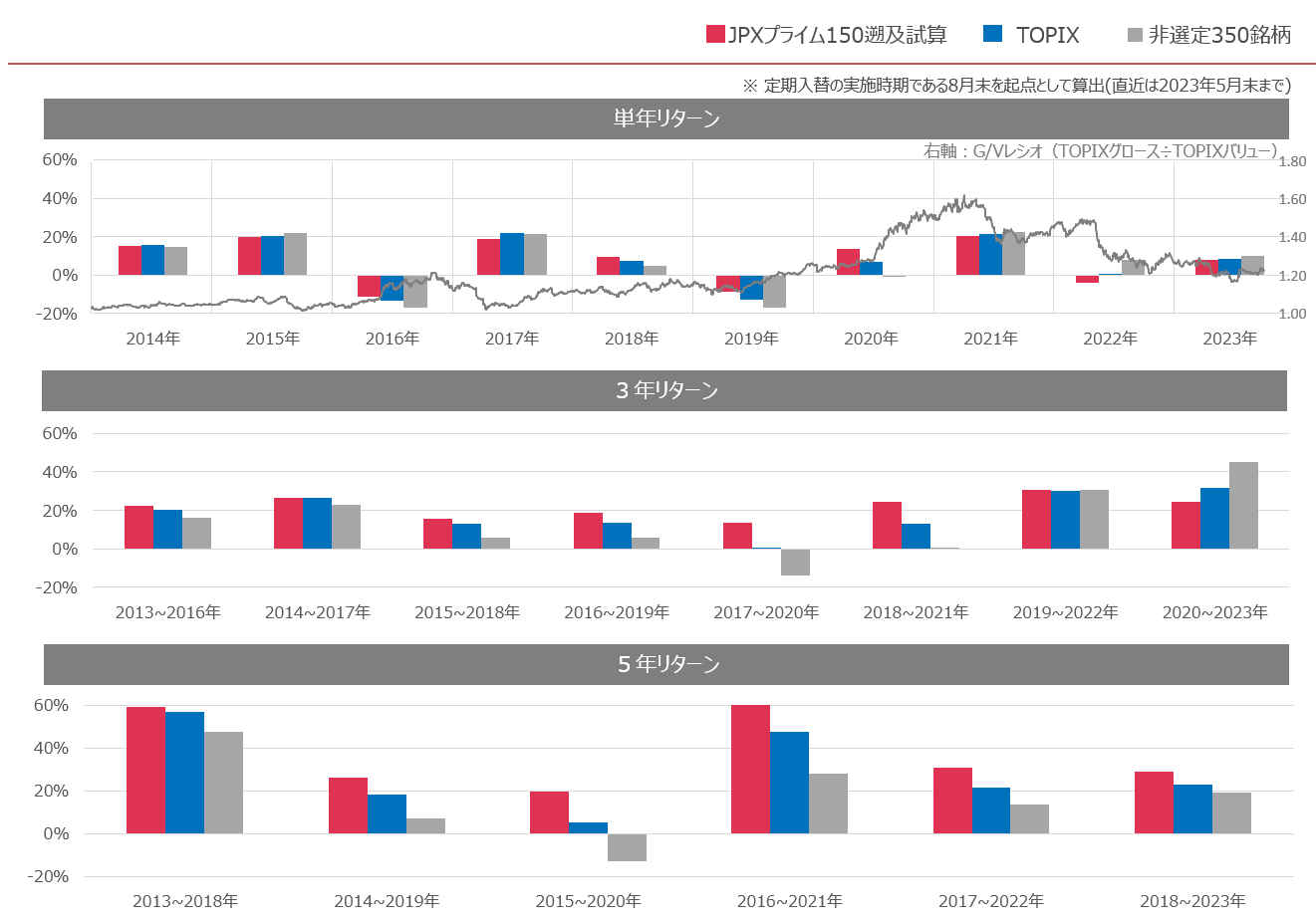

I am not yet entirely convinced whether the

iFree ETF JPX Prime 150 is something I’ll go with but the backtested long term performance of the

JPX Prime 150 index looks pretty compelling compared to TOPIX.

実証結果も解説:JPXプライム150指数は、もう一段成長することを期待した大型のグロース銘柄を選定【特別対談:後編】

https://media.monex.co.jp/articles/-/22620

実証結果も解説:JPXプライム150指数は、もう一段成長することを期待した大型のグロース銘柄を選定【特別対談:後編】

https://media.monex.co.jp/articles/-/22620

Re: iFree ETF JPX Prime 150 for Japan exposure tilt?

Posted: Sat Jul 13, 2024 11:22 am

by ToushiTime

One thing that put me off the Prime 150 is that it is price-weighted, like the Nikkei 225 and the Dow, unlike most indexes including TOPIX which are market-cap weighted.

For me, that and other issues raised here

https://www.smartkarma.com/insights/the ... -prime-150 are more important than the time-limited effect of the Bank of Japan reducing its TOPIX purchases. On the other hand, the latter could be an issue in the short or medium term for someone like you who is already retired.

Re: iFree ETF JPX Prime 150 for Japan exposure tilt?

Posted: Sat Jul 13, 2024 11:39 am

by TokyoWart

ChapInTokyo wrote: ↑Sat Jul 13, 2024 12:21 am

Fair enough.

A tilt makes sense for me because I am retired and wish to increase yen denominated holding in my portfolio to reduce exchange rate risk.

I am not yet entirely convinced whether the

iFree ETF JPX Prime 150 is something I’ll go with but the backtested long term performance of the

JPX Prime 150 index looks pretty compelling compared to TOPIX.

実証結果も解説:JPXプライム150指数は、もう一段成長することを期待した大型のグロース銘柄を選定【特別対談:後編】

https://media.monex.co.jp/articles/-/22620

実証結果も解説:JPXプライム150指数は、もう一段成長することを期待した大型のグロース銘柄を選定【特別対談:後編】

https://media.monex.co.jp/articles/-/22620

I would ignore this comparison completely because that ETF launched in January 2024 and the index did not exist before 2023. There are a number of issues with back testing even when an underlying index and fund actually existed during the period of time under consideration but in this case you don't even know if the ETF will be managed well enough to survive. In the real world, an index changes a bit each year (several names go in or out of the S&P500 each year) but for this index's pretend historical performance the back test is using some form of rules that imagine what the fund and index managers would have done during those prior time periods. That is just an exercise in imagination and would not inform my investing decision.

Re: iFree ETF JPX Prime 150 for Japan exposure tilt?

Posted: Sun Jul 14, 2024 4:42 am

by ChapInTokyo

TokyoWart wrote: ↑Sat Jul 13, 2024 11:39 am

ChapInTokyo wrote: ↑Sat Jul 13, 2024 12:21 am

Fair enough.

A tilt makes sense for me because I am retired and wish to increase yen denominated holding in my portfolio to reduce exchange rate risk.

I am not yet entirely convinced whether the

iFree ETF JPX Prime 150 is something I’ll go with but the backtested long term performance of the

JPX Prime 150 index looks pretty compelling compared to TOPIX.

実証結果も解説:JPXプライム150指数は、もう一段成長することを期待した大型のグロース銘柄を選定【特別対談:後編】

https://media.monex.co.jp/articles/-/22620

実証結果も解説:JPXプライム150指数は、もう一段成長することを期待した大型のグロース銘柄を選定【特別対談:後編】

https://media.monex.co.jp/articles/-/22620

I would ignore this comparison completely because that ETF launched in January 2024 and the index did not exist before 2023. There are a number of issues with back testing even when an underlying index and fund actually existed during the period of time under consideration but in this case you don't even know if the ETF will be managed well enough to survive. In the real world, an index changes a bit each year (several names go in or out of the S&P500 each year) but for this index's pretend historical performance the back test is using some form of rules that imagine what the fund and index managers would have done during those prior time periods. That is just an exercise in imagination and would not inform my investing decision.

Good point. I’m definitely going to tread warily here.

Re: iFree ETF JPX Prime 150 for Japan exposure tilt?

Posted: Sun Jul 14, 2024 4:56 am

by ChapInTokyo

ToushiTime wrote: ↑Sat Jul 13, 2024 11:22 am

One thing that put me off the Prime 150 is that it is price-weighted, like the Nikkei 225 and the Dow, unlike most indexes including TOPIX which are market-cap weighted.

For me, that and other issues raised here

https://www.smartkarma.com/insights/the ... -prime-150 are more important than the time-limited effect of the Bank of Japan reducing its TOPIX purchases. On the other hand, the latter could be an issue in the short or medium term for someone like you who is already retired.

Thanks for the smartkarma.com article link. Quite a scathing put down of the new index. The criticism of the new index for having greater churn than say the TOPIX index and structurally destined to buy high and sell low is also a valid point, although probably unavoidable in a growth tilted index.

One point that you might be mistaken about is that the JPX Prime 150 is a price weighted index. As far as I can see from the index’s documentation it seems to be market cap weighted the same as TOPIX.

As for how the BoJ stopping their TOPIX ETF purchases might affect the currently elevated price levels of the index, who can tell how that will play out. Me, I’m inclined to wait and see how things develop since my Japan stocks tilt is more like an active bet in a satellite portion of my portfolio and so I’ve no need to rush into it.

Re: iFree ETF JPX Prime 150 for Japan exposure tilt?

Posted: Wed Jul 17, 2024 12:36 pm

by ToushiTime

ChapInTokyo wrote: ↑Sun Jul 14, 2024 4:56 am

ToushiTime wrote: ↑Sat Jul 13, 2024 11:22 am

One thing that put me off the Prime 150 is that it is price-weighted, like the Nikkei 225 and the Dow, unlike most indexes including TOPIX which are market-cap weighted.

For me, that and other issues raised here

https://www.smartkarma.com/insights/the ... -prime-150 are more important than the time-limited effect of the Bank of Japan reducing its TOPIX purchases. On the other hand, the latter could be an issue in the short or medium term for someone like you who is already retired.

Thanks for the smartkarma.com article link. Quite a scathing put down of the new index. The criticism of the new index for having greater churn than say the TOPIX index and structurally destined to buy high and sell low is also a valid point, although probably unavoidable in a growth tilted index.

One point that you might be mistaken about is that the JPX Prime 150 is a price weighted index. As far as I can see from the index’s documentation it seems to be market cap weighted the same as TOPIX.

As for how the BoJ stopping their TOPIX ETF purchases might affect the currently elevated price levels of the index, who can tell how that will play out. Me, I’m inclined to wait and see how things develop since my Japan stocks tilt is more like an active bet in a satellite portion of my portfolio and so I’ve no need to rush into it.

Sorry, yes Prime 150 is market-cap weighted. Thanks for the correction. I mixed up that point when skimming my old notes about Nikkei vs TOPIX vs Prime 150.

Long-term I want maximum diversity, and don't want to pay a bit more for smart beta/tilts, so I went for TOPIX which has about 1700 stocks now, I think, versus 225 for the Nikkei and 150 for Prime. I only bought TOPIX to complement eMaxis All World Excluding Japan as SBI strangely doesn't offer eMaxis All Country (which includes Japan) for IDECO.