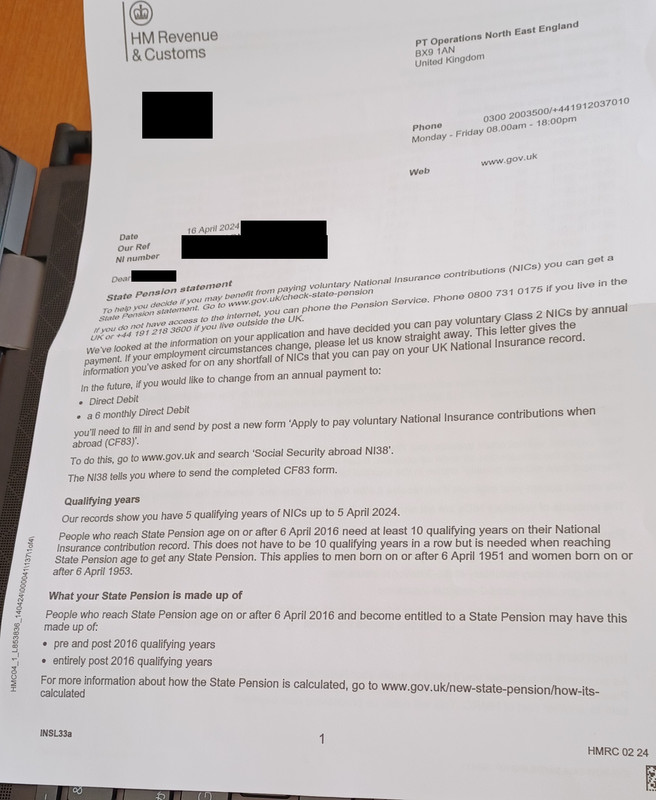

I recently enquired about my eligibility to make voluntary National Insurance contributions from abroad. Here is the letter I received in the post (within a month of applying, better than I was expecting!):

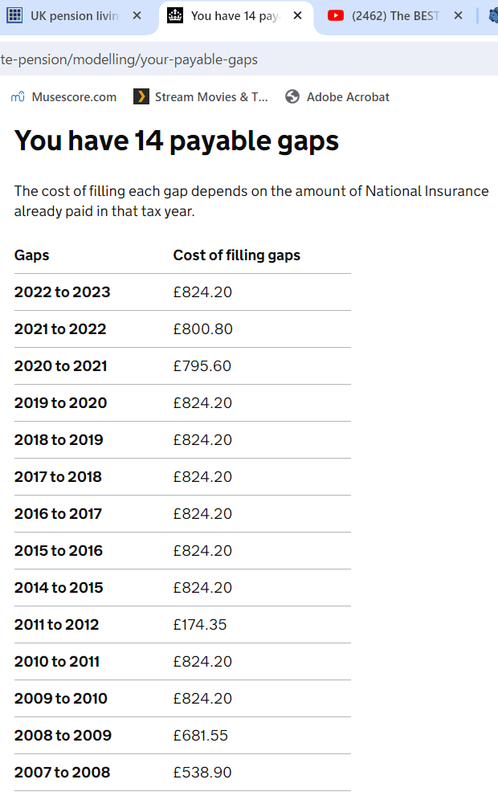

The payable gaps are somewhat manageable for me to pay by the deadline. However, if I log into the Government Gateway, it shows that after 2011, the payable gaps are a LOT higher:

Of course, I would be very happy if the correct amounts are what is shown in the letter, but the pessimist in me expects that this is some unfathomable error.

As a side note, I have 5 full years on record, which I have no complaints about, yet I have only ever been in full-time employment in the UK for one consecutive year, and that wasn’t even April to April. Any other work I had done was part-time for no longer than a few months in a row. The 5 years are acknowledged online, so hopefully that doesn’t get reassessed at some point.

So going forward, I have a few questions:

1. Do I have to pay all of the years listed in the shortfall table for any of them to be accepted?

– I definitely can’t do this by the deadline if the correct amounts are the higher ones.

2. If not, then can I choose the years to pay?

– i.e. cover the smaller gaps first (the earliest five years)

3. Once I hit the minimum ten years, is it better to continue paying the remaining 25 years over my working life, or is it better to put that money into Ideco/Nisa? (I'm 35)

- I think I probably will just so I have some security from my home country, but I’m wondering whether it’s worth the overall cost, transfer fees and taxes, particularly if the exchange rate doesn’t improve enough.

Thank you in advance for any insights. I imagine I will end up having to call HMRC, but I thought some people may be interested to see another example of someone going through the process of paying the UK pension from abroad.

Once I make my decision about NI, my next step will be to start investing, so apologies for the newbie questions that are sure to come!

(also sorry for the large images)