Page 3 of 4

Re: Hedging against a stock market crash

Posted: Mon Aug 05, 2024 9:21 am

by adamu

northSaver wrote: ↑Mon Aug 05, 2024 7:34 am

Any thoughts on this?

Monthly Tsumitate and ignore the noise.

Re: Hedging against a stock market crash

Posted: Mon Aug 05, 2024 9:23 am

by Tsumitate Wrestler

northSaver wrote: ↑Mon Aug 05, 2024 7:34 am

ChapInTokyo wrote: ↑Mon Aug 05, 2024 5:27 am

Looking on the bright side of life I suppose this week will be a great time to go buy a selection of individual Japanese stocks for the long run! Yum!

Indeed, the summer sale has finally started! Huge moves in TOPIX and N225 today (biggest move in over 50 years I heard) and that's after a big drop on Friday too. Gotta love how the markets over-react every single time! Almost every investor in Japan knew that the USD.JPY interest rate differential was going to start narrowing in the second half of this year, yet when it actually happens everyone (except the forum members on here hopefully) start selling like crazy. True, the impending Israel-Iran war isn't helping, and last week's US employment data was a bit of a shock, but still.. go figure!

Needless to say, now is an excellent time to load up on Japanese stock index funds if you have some spare cash (not including emergency cash of course). And global funds too if the carnage continues in Europe and the US. I'm not saying this in the bottom, just that you have to start buying them cheap at some point. A 20% drop warrants a decent buy order in my opinion, maybe as much as 50% of your spare cash. Save the rest for further drops. The only question is what to buy. ETFs are instant but not so good in NISA. Mutual funds take a while to go through. Hmm. Any thoughts on this?

Stick to the plan. Set and forget.

I would definitely not give a green light to blindly purchasing individual Japanese stocks or even TOPIX at these prices.

The party is over for companies as far as cheap/free debt and foreign capital. 5% of a portfolio still seems right to me for Japan.

Further the us market will probably be choppy/bearish until the Feds next meeting, especially us tech . So Japanese tech may have further to fall?

Re: Hedging against a stock market crash

Posted: Mon Aug 05, 2024 12:19 pm

by northSaver

Thanks adamu and TW. Good points. My NISA plan is 30万 per month and maybe you're right, I should stick to that no matter what. But my plan also says "invest any spare cash during a deep correction". Luckily I exchanged a chunk of GBP to JPY last month because I thought the rate was too good to be true. Most of the cash is still in my IB account waiting to be transferred to Japan. So I do have some spare cash and I should really follow my plan to invest it. I'm now thinking that I'll start buying ETFs tomorrow in my IB (taxable) account, not NISA. Actually I disagree that 5% Japanese stocks is about right, I think domestic stocks should be at least 10% - just my opinion. I'll be buying international stocks too though.

Re: Hedging against a stock market crash

Posted: Mon Aug 05, 2024 1:59 pm

by adamu

northSaver wrote: ↑Mon Aug 05, 2024 12:19 pmmy plan also says "invest any spare cash during a deep correction"

The problem is, you can't predict if this is the bottom, nor even if today is the highest prices will be for 50 years!

Anyway I just checked the new NISA that I started in January, it's up 9% on the money I put in. Going to bed now where I shall sleep soundly

Re: Hedging against a stock market crash

Posted: Mon Aug 05, 2024 2:19 pm

by Bubblegun

Well, that didn't bode well today on the S&P500. The 2024 stock summer sale is on. I will just keep DCA, as I have about 10 years before I retire. There isa bit of "seen this before" feeling.Black Wednesday,Asian finacial crisis, a dot com bubble,9/11, the Bear market in 2007, financial crisis in 2008, european mess, a flash crash, the crypto crash, 2020 crash. Seems to be something every few years. So, I'm gonna play like Ivor the Engine and chug along, or the wombles of Wimbledon, and just womble along the stock market. Very interesting to actually see this play out on my funds, because i never had any of this before the world of NISA, or online accounts and to see how currency manipulation really works visually.

Re: Hedging against a stock market crash

Posted: Mon Aug 05, 2024 10:51 pm

by ChapInTokyo

I think that for a long term buy and hold investor, the current crash is really a much needed market correction after the irrational exhuberance of the past few years. After all, it's definitely safer to buy after the prices have fallen than buying at the height of the market before the crash.

Now, I'm in the process of finalizing my shortlist of 20 or so individual Japanese stocks I will add to my portfolio, while keeping in mind the old Japanese adage about falling knives...

Re: Hedging against a stock market crash

Posted: Mon Aug 05, 2024 11:29 pm

by Ax6isB

This year is the first time in a long time, 20+ years I believe, that Japan has raised rates. The impacts to companies that have debt could take some time to come to fruition (or not). The nikkei may be in for an extended period of volatility.

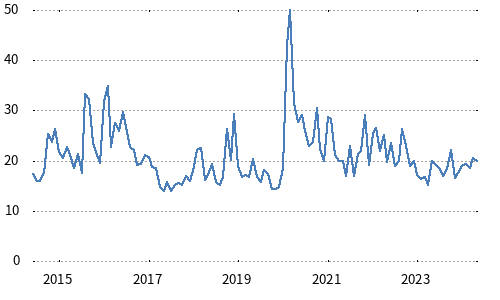

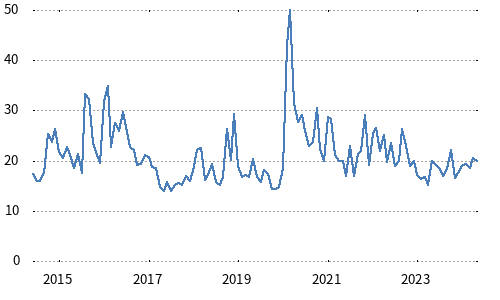

I found this

Seems like volatility in nikkei is exceeding S&P (which probably isn’t too surprising).

Regarding hedges, one thing you could

research is buying put options and seeing if this belongs in part of your portfolio.

Re: Hedging against a stock market crash

Posted: Tue Aug 06, 2024 1:16 pm

by beanhead

Ax6isB wrote: ↑Mon Aug 05, 2024 11:29 pm

Regarding hedges, one thing you could

research is

buying put options and seeing if this belongs in part of your portfolio.

Not to be advised if you don't know what they are.

This suggestion introduces considerable risk and also complexity.

Re: Hedging against a stock market crash

Posted: Tue Aug 06, 2024 11:38 pm

by ChapInTokyo

More volatility ahead, it seems.

Unwind of massive yen-funded carry has room to go, analysts say

By Reuters

August 7, 20245:22 AM GMT+9Updated 3 hours ago

https://www.reuters.com/markets/global- ... 024-08-06/

Hedge funds and other speculative investors, whose positioning is captured in a weekly report by the Commodity Futures Trading Commission, have only reduced their short yen positions by about 50%, Osborne said. The latest report was released last week.

The report “is a small window on FX positioning but the data along with the (so far) relatively limited correction in carry trade index returns suggest that there is more room for the carry trade to unwind in the short run," he said. "That would suggest more volatility in risk assets ahead and more strength in the JPY ahead."

Re: Hedging against a stock market crash

Posted: Wed Aug 07, 2024 1:05 am

by ChapInTokyo

According to this Nikkei article this morning, there’s a good chance that the yen will continue to strengthen, based on what happened in the aftermath of yen carry trades unwinding in the past.

Seems like volatility in nikkei is exceeding S&P (which probably isn’t too surprising).

Seems like volatility in nikkei is exceeding S&P (which probably isn’t too surprising).