nisa lumpsum or tsumitate nisa

Re: nisa lumpsum or tsumitate nisa

Interesting discussion, but length of time in the market has ALWAYS been the best indicator of performance, and thus it's pretty clear that front-loading with the regular NISA in order to maximize time in the market is the best answer... and the numbers posted here seem to bear that out... and by a longshot indeed.

Re: nisa lumpsum or tsumitate nisa

I would be extremely grateful if someone with better Japanese research skills could track down some definite answers.

1. Can you roll-over more than once?

2. Can you use the different tax-free allotments in NISA/New Nisa and Tsumitate differently?

3. What is the ideal maximizing strategy for those that can, or cannot lumpsum.

This dubious website suggests an ideal strategy.

https://diamond.jp/articles/-/250267

1. Can you roll-over more than once?

2. Can you use the different tax-free allotments in NISA/New Nisa and Tsumitate differently?

3. What is the ideal maximizing strategy for those that can, or cannot lumpsum.

This dubious website suggests an ideal strategy.

https://diamond.jp/articles/-/250267

- Roger Van Zant

- Veteran

- Posts: 644

- Joined: Tue Sep 01, 2020 7:33 am

- Location: Kyushu

Re: nisa lumpsum or tsumitate nisa

I can't afford to pay in 1.2m yen each year for the regular NISA, so I opted for the tsumitate-NISA instead, which I max out to 400,000 each year. Did I screw up? The above posts are kind of confusing me....

Investments:

Company DB scheme ✓

iDeCo (Monex) eMaxis Slim All Country ✓

新NISA (SBI) eMaxis Slim All Country ✓

Japanese pension (kosei nenkin) ✓

UK pension (Class 2 payer) ✓

Company DB scheme ✓

iDeCo (Monex) eMaxis Slim All Country ✓

新NISA (SBI) eMaxis Slim All Country ✓

Japanese pension (kosei nenkin) ✓

UK pension (Class 2 payer) ✓

- RetireJapan

- Site Admin

- Posts: 4887

- Joined: Wed Aug 02, 2017 6:57 am

- Location: Sendai

- Contact:

Re: nisa lumpsum or tsumitate nisa

Both types of NISA are perfectly fine. We're trying to figure out the ideal strategy if you were able to max out either type of NISA, but it's not possible to do that without knowing things that we can't know, like future government policy, future investment returns, etc.Roger Van Zant wrote: ↑Tue Feb 23, 2021 2:10 am I can't afford to pay in 1.2m yen each year for the regular NISA, so I opted for the tsumitate-NISA instead, which I max out to 400,000 each year. Did I screw up? The above posts are kind of confusing me....

If you can't afford to max out an ordinary NISA the point is moot: tsumitate is better.

English teacher and writer. RetireJapan founder. Avid reader.

eMaxis Slim Shady

eMaxis Slim Shady

Re: nisa lumpsum or tsumitate nisa

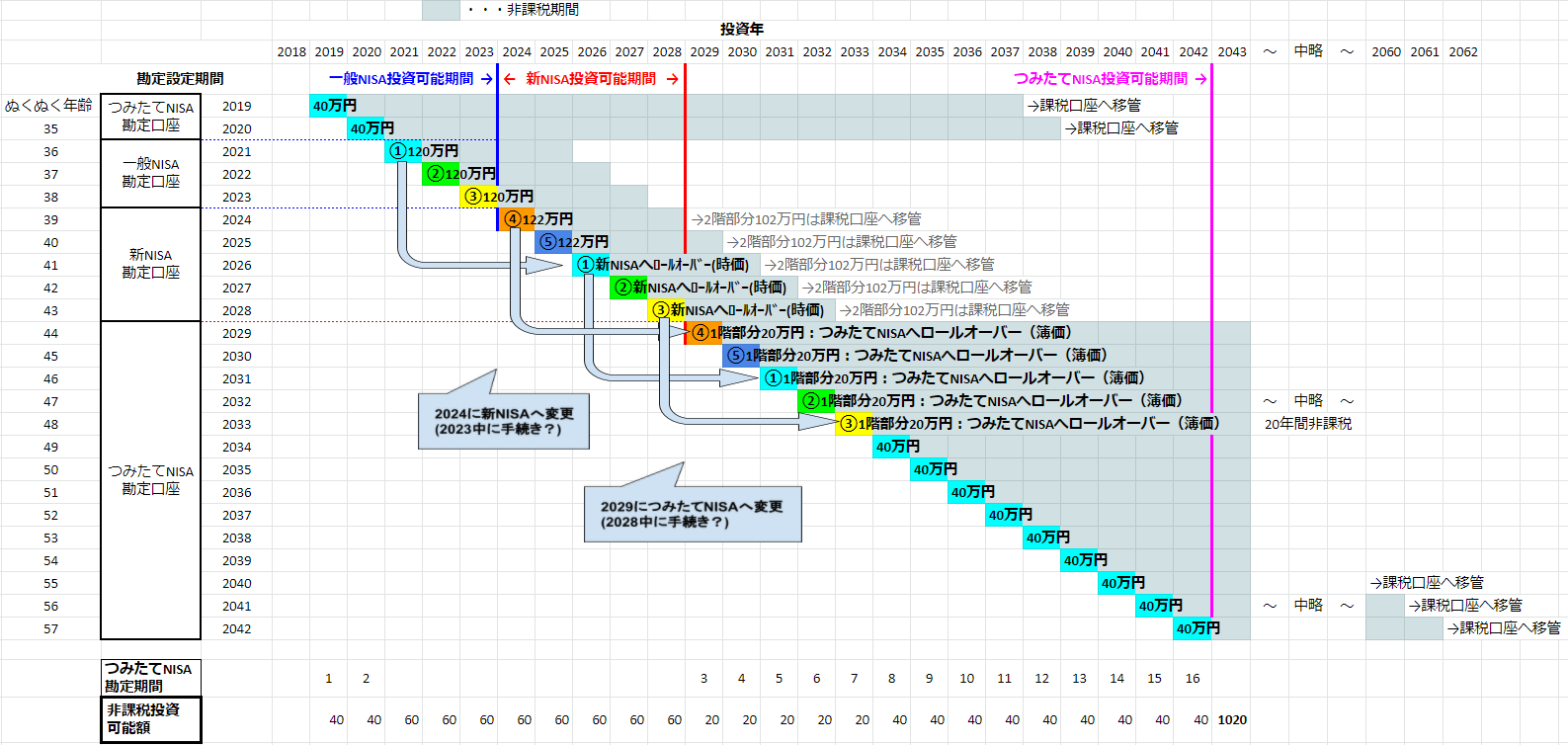

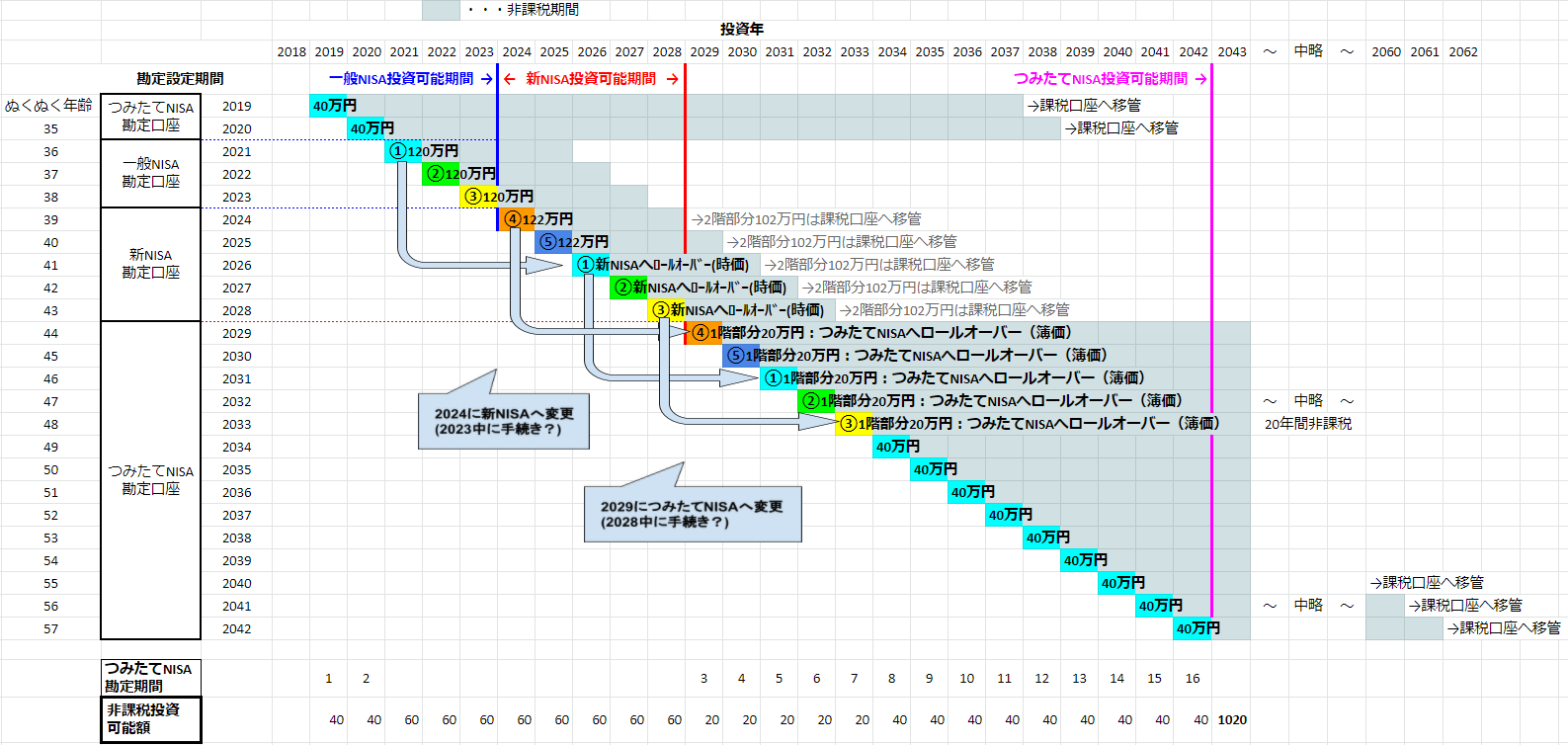

Even starting off with Tsumitate NISA you can change your plan to NISA, then rollover to New NISA and then get back to Tsumitate NISA (that has been recently extended 5 years to 2042 from the previous 2037, although the maximum you can get free tax is 20 years).

This guy started with Tsumitate NISA in 2019 (with SBI), then applied for a transfer to NISA plan in 2021 (he did it in advance applying in October so that he can start it in 2021). The whole plan to max out everything is as follows:

And the whole interesting article is here: https://nukunukusas.com/tsumitatenisa-to-nisa.

And the calculations with all of these plans mixed together go from the 8M Yens allowed during 20 years of Tsumitate NISA to 11.64M. Not a bad deal! Still I am wondering how all of these different NISA plans would work when it comes to tax free reporting (I guess everything would be done by the NISA provider anyway).

As for me, I also started the same way with Tsumitate NISA but in 2018 with SBI, then transfer to Rakuten in 2020 (unfortunately the first 2 years of 400K free tax were lost, as you the former provider will sell off all of it before the account is transferred to the new provider...). So here I am, in my second year of Tsumitate NISA with Rakuten (2020 and 2021), but the fourth of my 20 free tax years in Tsumitate NISA. I need to come up with a plan like the one on the blog.

I should have tried to investigate a bit more in advance but the language barrier did not let me get deeper on the plan. Well, it's never too late!

This guy started with Tsumitate NISA in 2019 (with SBI), then applied for a transfer to NISA plan in 2021 (he did it in advance applying in October so that he can start it in 2021). The whole plan to max out everything is as follows:

And the whole interesting article is here: https://nukunukusas.com/tsumitatenisa-to-nisa.

And the calculations with all of these plans mixed together go from the 8M Yens allowed during 20 years of Tsumitate NISA to 11.64M. Not a bad deal! Still I am wondering how all of these different NISA plans would work when it comes to tax free reporting (I guess everything would be done by the NISA provider anyway).

As for me, I also started the same way with Tsumitate NISA but in 2018 with SBI, then transfer to Rakuten in 2020 (unfortunately the first 2 years of 400K free tax were lost, as you the former provider will sell off all of it before the account is transferred to the new provider...). So here I am, in my second year of Tsumitate NISA with Rakuten (2020 and 2021), but the fourth of my 20 free tax years in Tsumitate NISA. I need to come up with a plan like the one on the blog.

I should have tried to investigate a bit more in advance but the language barrier did not let me get deeper on the plan. Well, it's never too late!

Last edited by ivanpgs on Tue Feb 23, 2021 8:03 am, edited 1 time in total.

Re: nisa lumpsum or tsumitate nisa

I am thinking along the same lines.

I am in my second year of Tsumitate, and I have just changed the "BONUS" setting to pay a lumpsum payment next month!

....

I will be looking to switch to Regular Nisa for 2022, with Rakuten. However, I may not be able to lumpsum 120万。

My wife may remain on Tsumitate.

....

I do wish there was a more official source on maximizing the benefits.

Re: nisa lumpsum or tsumitate nisa

I think there's a subtlety you've missed here. If you start with Tsumitate, then you get 20 years off the bat. If you start with NISA, you get however long NISA lasts. So let's say you start a NISA this year and put 400k away for 10 years until the end of 2030. Then you can roll over part of that into a Tsumitate NISA in 2031. But your tax protection from this year has ended. If you'd put it in a Tsumitate from the beginning, it would have been protected until 2040, and you'd still be able to put new money into a Tsumitate in 2031.

Yeah. The diamond and nukunuku posts were both useful. Summary seems to be:

1. Max out Ordinary NISA until 2023.

2. Rollover to New NISA for as long as possible.

3. Rollover the Level 1 of New NISA to a Tsumitate NISA if New NISA is not extended.

You could do your own Tsumitate in a taxable account this year to save up, then sell it and rebuy in a NISA in January next year. Even if it's not the full amount, it's better than nothing.

Last edited by adamu on Tue Feb 23, 2021 7:30 am, edited 1 time in total.

Re: nisa lumpsum or tsumitate nisa

My calculations are based on maxing out the limits within each NISA account so while the time period is shorter the larger initial amount should hopefully even things out. If we really want to get into the details of it, we'll also have to calculate the taxable portions as well but that's really too much work for a thought exercise.adamu wrote: ↑Tue Feb 23, 2021 7:26 am I think there's a subtlety you've missed here. If you start with Tsumitate, then you get 20 years off the bat. If you start with NISA, you get however long NISA lasts. So let's say you start a NISA this year and put 400k away for 10 years until the end of 2030. Then you can roll over part of that into a Tsumitate NISA in 2031. But your tax protection from this year has ended. If you'd put it in a Tsumitate from the beginning, it would have been protected until 2040, and you'd still be able to put new money into a Tsumitate in 2031.

If you're not able to max out the NISA limits, the calculations then start getting more iffy.

Re: nisa lumpsum or tsumitate nisa

Yeah, exactly. I'm just picking nits because you said

The real answer is it's complicated and depends on circumstances.

Which sort of implies people only planning on Tsumitate levels of investments would be better opening a NISA to start with.

The real answer is it's complicated and depends on circumstances.

Re: nisa lumpsum or tsumitate nisa

We do risk intimidating new investors. Perhaps a general guide would be in the order of tax-advantage.

1. I can only invest X ≤40 man a year - Tsumitate

2. I can only invest X ≤40 man a year, but I have that sum handy already - Lumpsum Tusmutate asap.

3. I can invest 120 man a year, but I cannot do it all at once - Regular Nisa with intermittent payments.

4. I can invest 120 man a year starting today Lump-sum regular Nisa asap.

.....

What is the most tax-efficient strategy,

Nisa->New Nisa with rollover -> Tsumitate Nisa (20 year plan)

I may not be able to max-out the regular NISA, what should I do?

Consider Tsumitate instead.

I do not understand all of this and I am overwhelmed.

You cannot go wrong with the Tsumitate Nisa and the Emaxis Slim All Country Fund.