Page 2 of 4

Re: Credit card tsumitate increase

Posted: Thu Feb 15, 2024 1:47 am

by Tsumitate Wrestler

styxomaniac wrote: ↑Wed Feb 14, 2024 2:43 pm

bryanc wrote: ↑Wed Feb 14, 2024 4:53 am

hi,

looking to start a tsumitate nisa-could anyone advise a good credit card to set this up with to get points? dont know if matters but currently have standard nisa with monex and sbi bank acct..thanks

If you're choosing SBI as your brokerage, the SMBC Platinum Preferred card is an excellent pairing. Here's why:

Platinum Benefits: Enjoy premium perks like a free English concierge, airport lounge access, and 7% cashback on convenience stores and select restaurants and a lot more

Offset Costs: While there's a 33,000 yen annual fee, investing the maximum 50,000 yen/month in your SBI Tsumitate-NISA earns you 30,000 yen in points (5% back). Use these points to cover your card fees or reinvest into your NISA. Some ETF will also give points so this combined will cover the annual fee of the card.

Sweeten the Deal: Get a 40,000 yen signup bonus when you spend 400,000 yen within the first three months.

Here is a referral link if you are interested, I get 10,000yen you get 12,000yen+ when you open a CC account and SBI account (conditions applies):

https://www.smbc-card.com/olentry/affil ... 402606911

I will be doing this once I finish with my Nisa at Rakuten, I will use SBI for my taxable.

Currently, I have the NL Gold. I cannot justify the platinum atm.

Post Nisa, I will probably mothball the Rakuten card, and only use the NL platinum preferred.

Re: Credit card tsumitate increase

Posted: Mon Feb 19, 2024 12:45 pm

by Adamakin86

bryanc wrote: ↑Thu Feb 15, 2024 1:04 am

that sounds very good indeed..

however the issue is my nisa is currently with monex..

Looks like we’ll be able to do Monex tsumitate with dCard from the summer. But there aren’t any fine details yet. I’m waiting to find out about the percentage of points. If it’s not great I’ll move my nisa to SBI and get the platinum preferred card.

Re: Credit card tsumitate increase

Posted: Sat Feb 24, 2024 1:17 am

by bryanc

This was something I wanted to ask about .

1.differences between monex and sbi

2.advantages of either

3.is it ok to have some in both?

4.transferring from monex to sbi

Thanks

Re: Credit card tsumitate increase

Posted: Sat Feb 24, 2024 1:37 am

by styxomaniac

I am quoting an old post by Ben from a different thread.

RetireJapan wrote: ↑Mon Dec 30, 2019 1:03 am

I have access to all three and they don't seem all that different. If I had to choose one I might go for SBI? They all have access to US-listed securities, etc.

The only differentiator would be if they are already in the Rakuten point/card system, in which case Rakuten Securities provides some chances to earn points.

Here are some info on how to switch to SBI.

https://www.sbisec.co.jp/ETGate/WPLETmg ... kikan.html

More resource:

https://www.retirejapan.com/blog/invest ... -in-japan/

Re: Credit card tsumitate increase

Posted: Tue Mar 12, 2024 1:00 am

by adamu

adamu wrote: ↑Sun Jan 28, 2024 5:17 amSBI/SMBC have not confirmed that they will increase the limit).

They have confirmed now, just not when it will be available (or whether it will earn points):

https://www.sbigroup.co.jp/news/pr/2024/0308_14475.html

Re: Credit card tsumitate increase

Posted: Fri Mar 22, 2024 4:40 pm

by styxomaniac

SBI: After system maintenance ends on Saturday, March 23, 2024 (midnight of March 24), you will be able to set up a credit card purchase up to 100,000 yen (for May purchases).

https://www.sbisec.co.jp/ETGate/?OutSid ... jc_home_02

Re: Credit card tsumitate increase

Posted: Fri Mar 22, 2024 4:56 pm

by adamu

styxomaniac wrote: ↑Fri Mar 22, 2024 4:40 pm

SBI: After system maintenance ends on Saturday, March 23, 2024 (midnight of March 24), you will be able to set up a credit card purchase up to 100,000 yen (for May purchases).

Oh that's quite a downgrade, Even if you have the top-tier card, you still end up with 1%-3% (as opposed to 5% previously) depending on your card usage. Even though maximum earnable number of points has increased, you have to subtract at least ¥10k from this maximum due to the particularly eggrerous ¥5M spend requirement. It doesn't include the invested money, and the Platinum Preferred card's "¥10k/¥1M" bonus caps out at ¥4M yen. So by requiring a ¥5M spend, they're effectively charging ¥10k for the new lower 3% rate, as you could be spending the money more effectively (on a different card) otherwise. I'm guessing people will be earning fewer points on average under this new scheme, which is certainly not an accident.

Another example against chasing point programs. They are doomed to be downgraded and made more complex with extra conditions, because they're not in business to give stuff away for free.

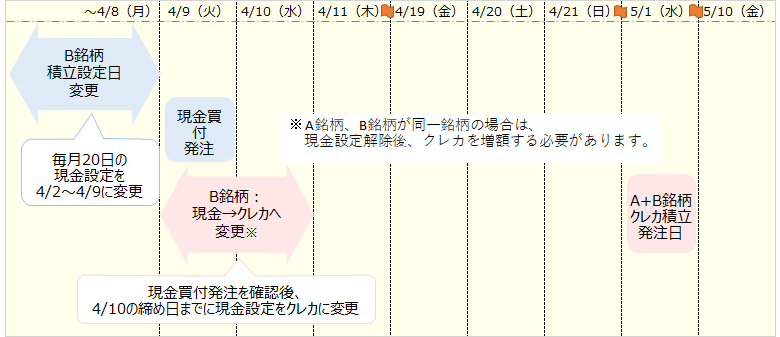

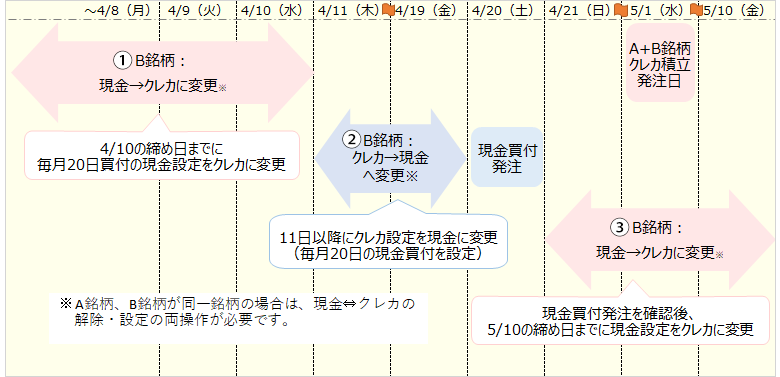

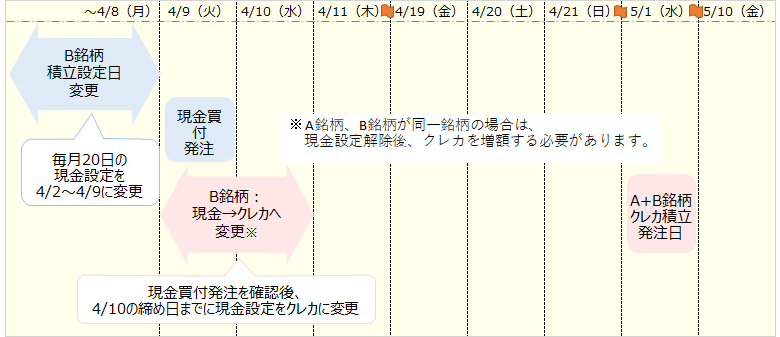

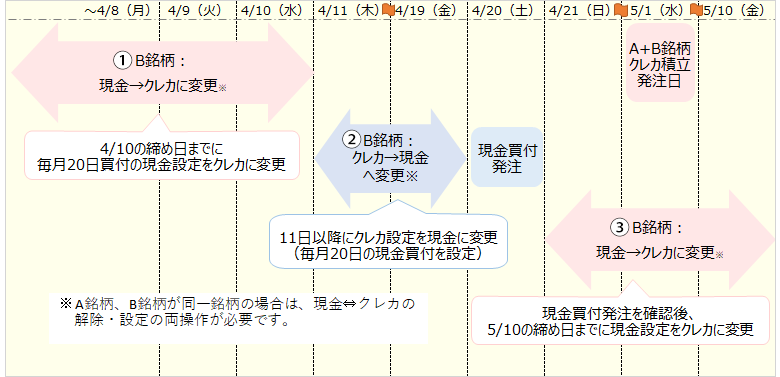

Also good luck following the

instructions for how to change the settings without missing a month

Re: Credit card tsumitate increase

Posted: Sat Mar 23, 2024 2:37 am

by adamu

Just running the numbers on the top tier a bit more.

Accounting for the missing ¥10k for the last ¥1M.

If you spend ¥4M on the card you get ¥24k points from tsumitate.

If you spend ¥5M on the card, you get ¥10k fewer points on the last ¥1M from the card, but get ¥36k points from tsumitate, which cancels out to ¥26k points for a real rate of 2⅙% (or ¥2k for your last million).

Re: Credit card tsumitate increase

Posted: Sat Mar 23, 2024 2:58 pm

by adamu

adamu wrote: ↑Fri Mar 22, 2024 4:56 pm

Also good luck following the

instructions for how to change the settings without missing a month

Funnily enough it won't let me update the CC payment from 50k to 100k because that would take me over 1.2M projected deposits (already have it set up to do 50k cash and 50k CC from April until EOY).

However, any updated CC setting will apply from 1 May (not April).

I also can't cancel the 50k cash setting, because that is due to come out early April, and cancelling it now would cause a missed order in April.

So what I need to do is wait for the cash order to be placed automatically in early April (BUT BEFORE 10 April, the CC setting deadline), then cancel the cash setting to free up 50k of predicted payments from May, which will then (hopefully) let me up the CC setting from 50k to 100k effective May onwards. I'll report back on 3rd April or so if it worked...

Re: Credit card tsumitate increase

Posted: Thu Mar 28, 2024 3:30 pm

by styxomaniac

I believe it will work as I've previously used the same approach. What I opted to do is use the 100k CC in my Growth NISA, while keeping all Regular T.NISA as cash purchases since Growth NISA has more of a wiggle room than Regular T.NISA