adamu wrote: ↑Mon Feb 22, 2021 3:34 am

That works, but you're only guaranteed to be covered for 5 years. If you don't invest more, you'd have been better sticking with Tsumitate.

Yeah but the same holds whether you're in NISA or tsumitate NISA.

Hold your NISA for as long as you're allowed to, roll them over every year, then on the 11th year switch to tsumitate NISA.

Actually, wouldn't you also be able to do 20 years of tsumitate NISA once the regular NISA periods and rollovers are done?

Why only 10?

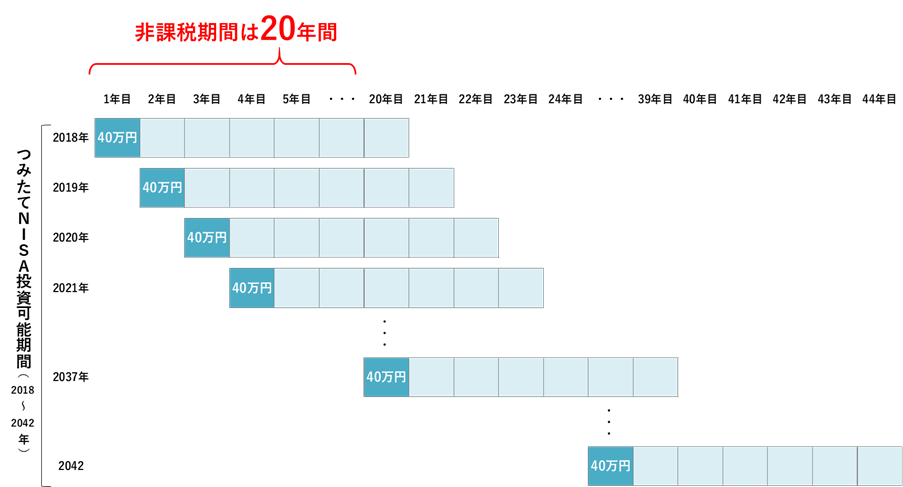

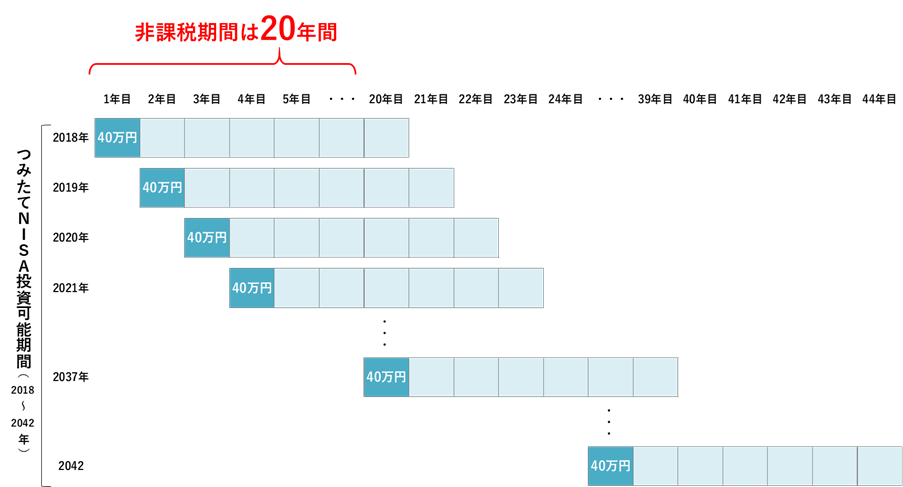

Looking at the FSA website, it seems like you're only able buy funds in the tsumitate NISA account until 2037, which is 16 years from now. So assuming you start now, you'd be able to do regular NISA until 2029, roll over till 2034, then buy 3 rounds tsumitate funds till 2037 which will compound till 2057 for 20 years.

Initial NISA allotment $12,000 per year at 8% for 5 years yields a balance of $76,031.15

https://www.interestcalc.org/?initial_i ... requency=5

5 years of continous rollover with no new investments yields $111,714.70

https://www.interestcalc.org/?initial_i ... requency=5

3 rounds of tsumitate at $4,000 each year yields $154,752.80

https://www.interestcalc.org/?initial_i ... requency=5

then let them compound for another 20 years for a final total of $721,296.17

https://www.interestcalc.org/?initial_i ... requency=5

$721,296.17 over a 30 year period out of $72,000 initial investment.