The withholding tax isn't included in the fund expenses. According to their monthly reports both the SBI and Rakuten funds lag their benchmark. I think this is where the taxation problem is showing up. The eMaxisSlim tracks its index much more closely and is therefore the better fund.

One fund to rule them all?

-

fools_gold

- Veteran

- Posts: 428

- Joined: Wed Sep 27, 2017 4:53 am

Re: One fund to rule them all?

Re: One fund to rule them all?

That's a good point. It would be nice to see a performance comparison of the same amount invested in all the funds at the same time.fools_gold wrote: ↑Sun Sep 13, 2020 3:02 am The withholding tax isn't included in the fund expenses. According to their monthly reports both the SBI and Rakuten funds lag their benchmark. I think this is where the taxation problem is showing up. The eMaxisSlim tracks its index much more closely and is therefore the better fund.

It would also be very interesting to see how much SBI/Rakuten lag their benchmarks compared to their underlying ETFs.

Maybe I'll look it up if I get some downtime and nobody beats me to it (or find a Japanese blogger that's already done it).

edit: Here's a quote from the Shintaro Money eMaxis Slim All Country article:

Rough translation: While eMaxis Slim just loses out to SBI on actual costs, when taking into account the triple taxation (discussed later in the article), eMaxis slim remains the most cost effective global fund (or: what fools_gold said).尚、実質コストでは若干SBI・全世界株式インデックス・ファンド(雪だるま)に負けますが、後述する3重課税を考慮すると、eMAXIS Slim 全世界株式(オール・カントリー)が最も低コストで全世界株式に投資できるファンドという事になります。

- RetireJapan

- Site Admin

- Posts: 4731

- Joined: Wed Aug 02, 2017 6:57 am

- Location: Sendai

- Contact:

Re: One fund to rule them all?

The fund comparison sounds like something interesting to do for the blog

Can we put a list together of funds in different categories to try it with? I'm guessing all-country stocks, international bonds, developing markets might be a good start?

Can we put a list together of funds in different categories to try it with? I'm guessing all-country stocks, international bonds, developing markets might be a good start?

English teacher and writer. RetireJapan founder. Avid reader.

eMaxis Slim Shady

eMaxis Slim Shady

Re: One fund to rule them all?

Sounds good. I've been reading some more Shintaro Money and their articles are excellent, impartial, and seem to have everything covered. It's all in Japanese though, so not very accessible. Would be nice to have the English info, with the added perspective of being a non-Japanese investor.

I think the most useful categories are:

Stocks: Global, Developed, Emerging, Japan. Differences between US ETFs (VT), Japanese ETFs (2559 - just learned about this today), and Japanese funds (and within Japanese funds, the difference between real funds, and funds that just wrap US ETFs).

Bonds: International, Domestic.

I think the most useful categories are:

Stocks: Global, Developed, Emerging, Japan. Differences between US ETFs (VT), Japanese ETFs (2559 - just learned about this today), and Japanese funds (and within Japanese funds, the difference between real funds, and funds that just wrap US ETFs).

Bonds: International, Domestic.

Re: One fund to rule them all?

Oh wow, so an ETF version that is free to trade with a 0.078% cost basis.

https://www.rakuten-sec.co.jp/web/domes ... s-etf.html

I suppose having to buy shares and not yen increments would be annoying. However, I wonder if anyone can track down the true cost of the fund?

Re: One fund to rule them all?

Shintaro Money comes to the rescue againKanto wrote: ↑Sun Sep 13, 2020 12:38 pmOh wow, so an ETF version that is free to trade with a 0.078% cost basis.

https://www.rakuten-sec.co.jp/web/domes ... s-etf.html

I suppose having to buy shares and not yen increments would be annoying. However, I wonder if anyone can track down the true cost of the fund?

https://shintaro-money.com/maxis-ac-2559/

Basically, it uses the same mother funds as eMaxis Slim, but although it's slightly lower cost, it also lags the benchmark (in this case beneficially, but raises some red flags for the future). The article says it's a new fund so it's still too early to tell. It also says that it's subject to the new foreign tax reduction introduced this year. I don't really know much about that yet - but I posted a couple of links on another thread planning to investigate more.

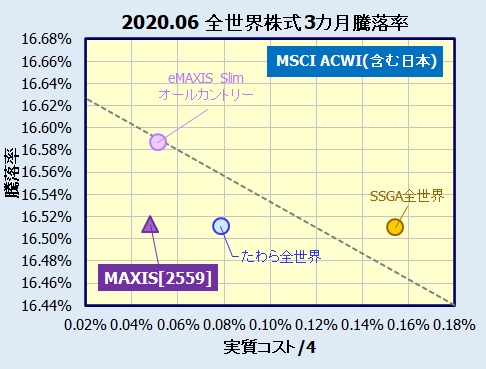

I don't fully understand this graph. I think left = better (because the costs are lower), but the line represents the benchmark, so drifting from the line is bad.

-

fools_gold

- Veteran

- Posts: 428

- Joined: Wed Sep 27, 2017 4:53 am

Re: One fund to rule them all?

I think I've figured it out. The x-axis is the actual costs divided by four. The costs are divided by four because the quoted costs are are annual, but the graph is only looking at a 3 month period. The y-axis is the performance over the past 3 months. The dashed line represents the benchmark minus the actual costs divided by four. An efficient fund should be on this line and like you say, left is better because costs are lower. Under the line means it is underperforming. The Maxis ETF seems to be underperforming by about 0.1% in addition to the actual costs of 0.192%. The chart shows a 3 month performance of 16.51% for the ETF vs. 16.59% for eMaxisSlim. The benchmark looks to be about 16.65%.

Re: One fund to rule them all?

Great explanation, makes sense to me, thanks.

Seems I misunderstood when I said that the ETF has drifted from the benchmark in a beneficial way.

Re: One fund to rule them all?

Looking at the eMAXIS 全世界株式(オール・カントリー) country composition on the Shintaro website:

https://shintaro-money.com/wp-content/u ... 2559-2.jpg

I don't understand why these numbers differ from the MSCI-AWCI:

https://www.msci.com/documents/10199/8d ... 2942e3adeb

For instance according to the MSCI website China is a little over 5% but the eMAXIS fund gives China just 1.4% as share of total index or why the Cayman Islands is so high on the eMAXIS list. Does anyone know what is going on here?

https://shintaro-money.com/wp-content/u ... 2559-2.jpg

I don't understand why these numbers differ from the MSCI-AWCI:

https://www.msci.com/documents/10199/8d ... 2942e3adeb

For instance according to the MSCI website China is a little over 5% but the eMAXIS fund gives China just 1.4% as share of total index or why the Cayman Islands is so high on the eMAXIS list. Does anyone know what is going on here?

Re: One fund to rule them all?

It says in the article:

Although the Cayman Islands are number 1 for emerging markets, in practice they are Chinese businesses.新興国の中ではケイマン諸島が1位となっていますが、これは事実上、中国企業です。

Maybe eMaxis Slim is doing something strange like buying Cayman-domiciled wrappers of Chinese businesses to avoid regulation/taxes? Or maybe the companies are actually registered there, but MSCI reports them as Chinese.

eMaxis Slim also uses the JPY version of ACWI, I'm not sure if there's a publicly available document for that.