fools_gold wrote: ↑Sat May 02, 2020 12:10 pm

jcc wrote: ↑Tue Apr 28, 2020 4:40 am

I'm not a fan.

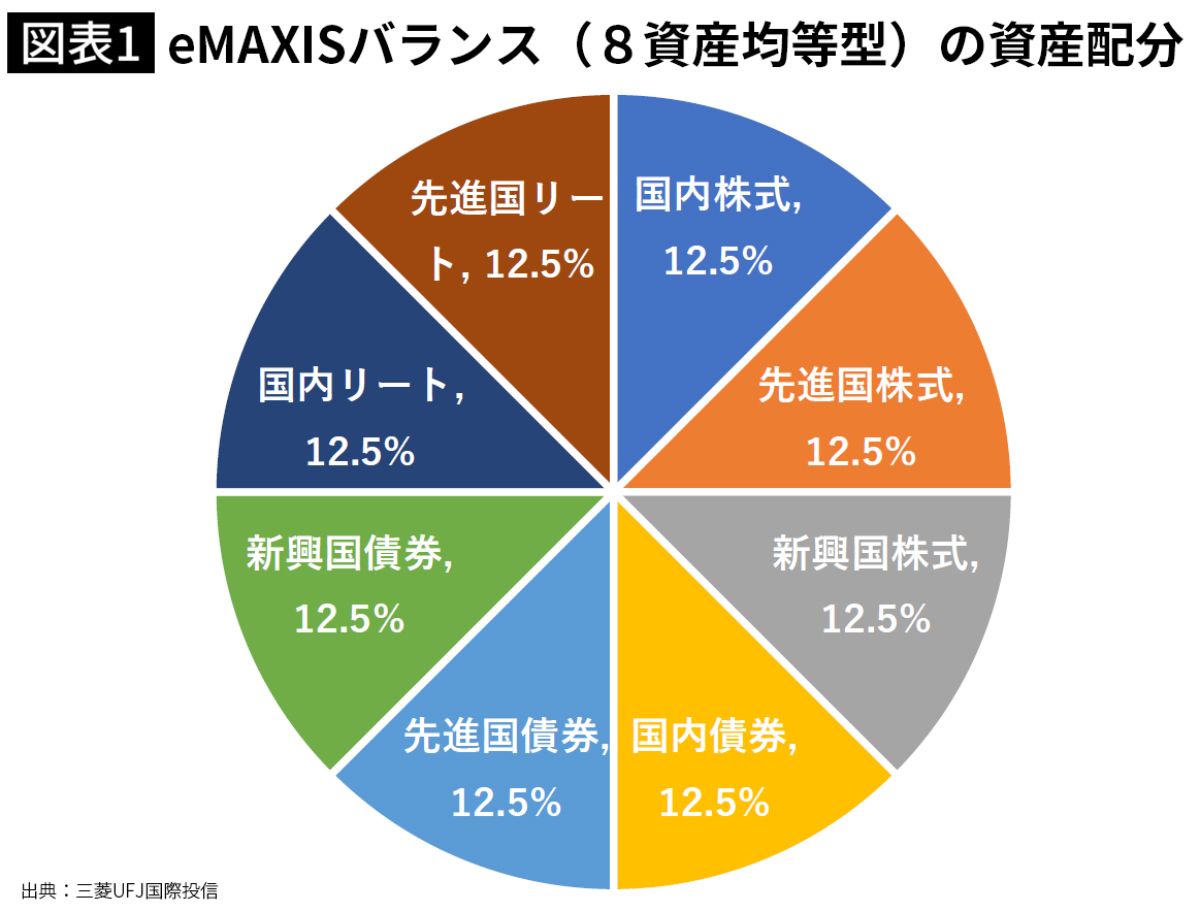

It's an unweighted balancing. But weighting by market share is a better idea.

If has a MASSIVE 37.5% of bonds and 1/3 of those are developing nations. The stock portfolio is also even split jp/developing/developed, while in reality the vast majority of the market cap is in developed nations.

It's a gimmick.

There's nothing wrong with having all 8 of those sectors(though personally I'd skip on both jp and emerging bonds), but they definitely should not be in equal proportions. Risk adjusted returns would be higher on a market cap balanced mix.

You should consider how much you want in stocks and bonds and then either use market cap balanced world funds(like

http://www.morningstar.co.jp/FundData_s ... 2018103105 ) or balance your own with a mix of domestic + developed + emerging.

Personally, I like the emaxis slim 8-way. I ran 3 different portfolios through myindex.jp which allows you to backtest them for 20 years.

1. 80% developed market stocks, 10% Japanese stocks and 10% emerging. This roughly corresponds to international stocks by market cap.

2. 20% developed market bonds, 64% developed market stocks, 8% Japanese and 8% emerging. This corresponds to 80% international stocks with 20% developed market bonds.

3. The 8-way split used in the emaxis slim 8-way fund.

The emaxis fund was the best performer by quite a margin. 5.9% annual returns vs 4.8% for the other two portfolios. Volatility was a lot less at 12.2% vs 18.5% for all stocks and 15.9% for the 80/20 portfolio. Balanced funds are also a better fit for tsumitate NISA because they automatically rebalance. If you mix and match funds you can't easily rebalance between them.

I would bring it to your attention that we just hit a bump in the road where stocks plummeted and the value of 37.5% bond allocation would be massive. You are buying stocks during the build up to the tech bubble and selling them right after the corona dump. Of course a stock heavy portfolio loses in this particular 20 year span.

Shift that 20 year window a year back from now, or even an year forward and that portfolio would probably fall behind.

Backdating is a simple mistake frequently made. It needs to be done against multiple ranges as well as multiple time periods to have ANY kind of confidence. "Past performance is no guarantee of future results." This is not a filler statement. Places are required to write this because it is true.

You can pick a particular span of years and then make an AMAZING portfolio for that span, and find that in the next span of years it performs very poorly.

If you are going to do backdating, do it against multiple spans and with multiple different start and end dates. Starting 20 years ago until now is a terrible range to use(entirely coincidentally)

Just to further highlight how flawed this thinking is, the highest performing commodity in the last 20 years is GOLD. Yes, that's right. It's value is 561% of what it was 20 years ago. But if you go back 40 years instead, it actually has less value.

And if you pick out the 100 year returns of gold it's 700%... annualized that's a 2% return. That's well below inflation

Take care