I assume you are thinking that Japanese fiscal policy is too loose and hence the yen will weaken?

However Fiscal policy is loosening everywhere. It’s not just Japanese Government spending that happens here that will influence the exchange rates. Trump’s fiscal plans are absurd, Xi is having to stimulate in China and the UK just announced a hugely ambitious plan to spend a lot more money on public services.

Could be a race to the bottom, and countries like Japan and China that are net creditors are in a stronger position that those who require external funding to finance their lifestyles…

Yen keeps going from strength to strength!

Re: Yen keeps going from strength to strength!

:

:

This Guide to Japanese Taxes, English and Japanese Tai-Yaku 対訳, is now a little dated:

https://zaik.jp/books/472-4

The Publisher is not planning to publish an update for '23 Tax Season.

:

This Guide to Japanese Taxes, English and Japanese Tai-Yaku 対訳, is now a little dated:

https://zaik.jp/books/472-4

The Publisher is not planning to publish an update for '23 Tax Season.

-

sutebayashi

- Veteran

- Posts: 710

- Joined: Tue Nov 07, 2017 2:29 pm

Re: Yen keeps going from strength to strength!

The local fiscal situation is a decent part of my pessimism, but I still see monetary policy as super loose (balance sheet) and they claim to want to stable inflation of 2% (as opposed to stable prices = stable currency) although they have been exceeding that inflation target; the trade deficit these days too.

The US situation is not great either, I think the FOMC was wrong to cut interest rates by 50 bps when their inflation remains above target too, but the dollar is the global reserve currency, and to bring their fiscal situation back to balance they “only” need to get spending back to levels of 5 years ago (it’s the cleanest pair of dirty knickers!). I think there is optimism about that right now which is dollar favourable (but may be betrayed - not sure if Musk and Ramaswamy will be able to deliver 2 trillion bucks of cuts). The US tax revenues have been growing, so if they can just get spending down a bit a balanced budget and even debt reduction is at least within the realms of possibility. I’m not sure which part of the Trump fiscal plans you think is absurd, but we have to wait and see what is actually done and passed through Congress anyway.

For Japan on the other hand, it doesn’t even seem to be a point of debate. The populace isn’t demanding fiscal sanity here and there is no political force suggesting it either. Inflating away the accumulated debt seems to be the consensus decision of the Japanese isles.

I am not deeply up to speed on the UK but I saw some headlines comparing a recent fiscal announcement there to the reaction to the Truss mini-budget, so I’ve got a small flutter on right now shorting GBP/USD, but it’s for shlts and giggles as Austin Powers might say. Working out ok so far!

Japan as a whole has a big current account surplus, but I think that’s due to folks like us and other non-government actors prudently holding foreign assets, and to that extent I don’t think we need worry much about the yen.

Those of earning salaries in yen are selling ourselves short though. “Selling Japan by the monme”, or something like that. It makes me want to FIRE, if working gets old or I get too old to work.

The US situation is not great either, I think the FOMC was wrong to cut interest rates by 50 bps when their inflation remains above target too, but the dollar is the global reserve currency, and to bring their fiscal situation back to balance they “only” need to get spending back to levels of 5 years ago (it’s the cleanest pair of dirty knickers!). I think there is optimism about that right now which is dollar favourable (but may be betrayed - not sure if Musk and Ramaswamy will be able to deliver 2 trillion bucks of cuts). The US tax revenues have been growing, so if they can just get spending down a bit a balanced budget and even debt reduction is at least within the realms of possibility. I’m not sure which part of the Trump fiscal plans you think is absurd, but we have to wait and see what is actually done and passed through Congress anyway.

For Japan on the other hand, it doesn’t even seem to be a point of debate. The populace isn’t demanding fiscal sanity here and there is no political force suggesting it either. Inflating away the accumulated debt seems to be the consensus decision of the Japanese isles.

I am not deeply up to speed on the UK but I saw some headlines comparing a recent fiscal announcement there to the reaction to the Truss mini-budget, so I’ve got a small flutter on right now shorting GBP/USD, but it’s for shlts and giggles as Austin Powers might say. Working out ok so far!

Japan as a whole has a big current account surplus, but I think that’s due to folks like us and other non-government actors prudently holding foreign assets, and to that extent I don’t think we need worry much about the yen.

Those of earning salaries in yen are selling ourselves short though. “Selling Japan by the monme”, or something like that. It makes me want to FIRE, if working gets old or I get too old to work.

Re: Yen keeps going from strength to strength!

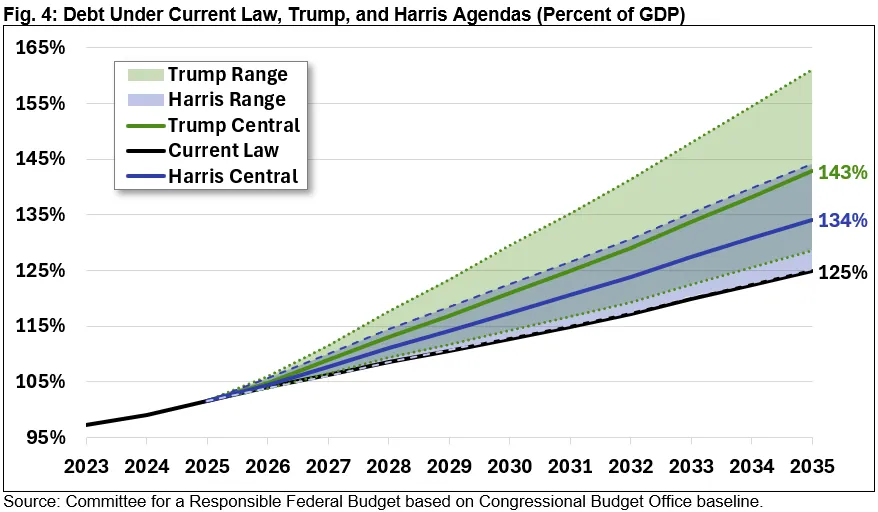

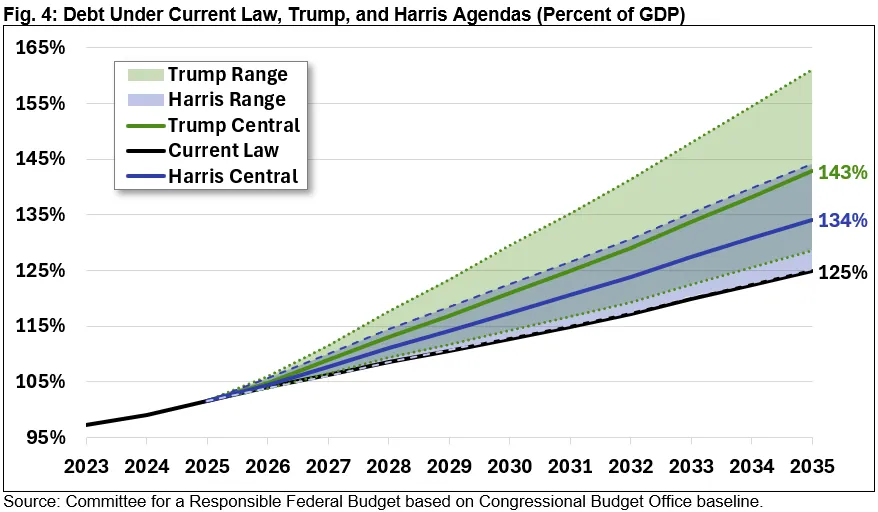

Here is the effect of Trump's policy proposals.. compare with Japan's fiscal deficit of around 6% ... the whole thing is absurd, as is his tariffs proposal. Will be very interesting to see what happens if anything like this really goes ahead. Remember he has a popular mandate and a red sweep so it's certainly a non-zero chance. Not sure how you think the US is going anywhere near a balanced budget.

https://www.crfb.org/papers/fiscal-impa ... aign-plans

https://www.crfb.org/papers/fiscal-impa ... aign-plans

Under President Trump’s plan, we estimate debt would grow rapidly over time. Under our central estimate, debt held by the public would rise from 102 percent of GDP at the beginning of FY 2026 to 143 percent of GDP by the end of 2035 – 18 percent of GDP above current law projections.

Although our year-by-year estimates are less precise, we also estimate annual deficits would rise under President Trump’s plan. Based on data from CBO, we project deficits will grow from 6.5 percent of GDP in FY 2025 to 7.0 percent of GDP in 2035 under current law. Under our central estimate of President Trump’s plan, deficits would reach 9.7 percent of GDP in 2035, with a range of 7.7 to 12.2 percent of GDP in other scenarios – the highest levels reached outside of a war or recession.

-

sutebayashi

- Veteran

- Posts: 710

- Joined: Tue Nov 07, 2017 2:29 pm

Re: Yen keeps going from strength to strength!

I see!

I’m not at all sure that it is, but I rate their chances better than I do Japan’s. At a minimum I expect US annual spending will be reduced in 2 years times. I know little of the reality of the US budget though, and what spending cut proposals will come up against, so I of course may be completely wrong. But this talk of cutting spending seems to have a non-zero chance of happening, to me. The CFRB doesn’t appear to mention it though.Not sure how you think the US is going anywhere near a balanced budget.

-

captainspoke

- Sensei

- Posts: 1571

- Joined: Tue Aug 15, 2017 9:44 am

Re: Yen keeps going from strength to strength!

I'll take my uncle jerry's POV--I'm not going to decide things based on what might happen, only what has happened.

I'd agree that Trump's proposals are dangerous, or at least beyond the pale, and I wouldn't want his wish list to come true.

But let's see what actually happens.

It may look like Congress is republican, but those folks in the House could barely elect a speaker. I hope that they have an equal or more difficult time arguing among themselves while trying to rubber stamp something that comes from trump.

I also am aware that he can just proclaim some of his agenda via executive order (which might be challenged, but that takes time).

Re: Yen keeps going from strength to strength!

I think we can all agree there is a lot of uncertainty about what policies will actually get implemented as part of the second coming of Trump. However, he campaigned on and was elected on a platform to massively cut taxes and increase spending. I think it’s fairly safe to assume this is going to happen to the most extent. He did it the first time around and promised to do it again.

I don’t think there is a plan or any detail to be costed from DOGE. Throwing around numbers like two trillion is typical Musk hyperbole, like the self driving cars he has been promising for a decade or more (and selling!!!) that are no nearer now than they were then.

The facts are both US political parties are committed to blowing up the fiscal deficit, and there is no MoF trying to restrain them like there is here. You complain reducing the deficit isn’t part of the conversation here - but it certainly isn’t in the US either.

I don’t think there is a plan or any detail to be costed from DOGE. Throwing around numbers like two trillion is typical Musk hyperbole, like the self driving cars he has been promising for a decade or more (and selling!!!) that are no nearer now than they were then.

The facts are both US political parties are committed to blowing up the fiscal deficit, and there is no MoF trying to restrain them like there is here. You complain reducing the deficit isn’t part of the conversation here - but it certainly isn’t in the US either.