Greetings RJ community!

Please allow me to ask: Does anyone have any experience/advice regarding FWD Insurance (fwd.com)?

They appear to be a relatively new life insurance company (established in 2013), with offices only in Asia (10 countries, including Japan).

I received a very competitive quote for a 25-year term life insurance, but, from what I understand, it is a DECREASING term policy, of which the payout is anywhere from over 90,000,000 JPY (after year one) to just over 7,000,000 (final year of the policy) depending on if and when I die.

I plan for my family to be self-insured/financially independent by the time the policy expires, so I am not too concerned about the low payout in the later years.

The monthly premium is less than half the cost of an equivalent level term life insurance offered by other companies (put another way, the monthly premium for a level term life insurance policy with a payout of 50,000,000 JPY to 60,000,000 JPY is 2.5 times the price).

Thank you in advance for any advice/suggestions you may be able to offer.

EJDT

FWD Insurance (for term life insurance)

-

TBS

Re: FWD Insurance (for term life insurance)

Does their website have a premium simulator for term life insurance?

I had not heard of them, but the concept of decreasing coverage as you age and become wealthier is a good one. Without knowing FWD's premiums it is hard to gauge their competitiveness compared to buying shorter term policies from the traditional insurers and adjusting the coverage manually yourself as you age.

I had not heard of them, but the concept of decreasing coverage as you age and become wealthier is a good one. Without knowing FWD's premiums it is hard to gauge their competitiveness compared to buying shorter term policies from the traditional insurers and adjusting the coverage manually yourself as you age.

Re: FWD Insurance (for term life insurance)

Thank you very much for your reply, TBS.

Excellent suggestion. Unfortunately, FWD Japan's website does not have a premium simulator for term life insurance (nor any other life insurance policy for that matter): https://direct.fwdlife.co.jp/fli_front/ ... 6279729358.

The monthly premium is: 6,506 JPY.

For your reference, I am a healthy (good 健康診断書, which must be submitted) 39 year-old non-smoker. The policy would last until I am 65.

Without inundating you with too much detail, the policy includes payout even if I die from the "Big 3" (3大疾病). The remaining conditions are pretty standard (ie, I cannot die from cancer in the first 90 days, my dependents cannot claim if I commit suicide in the first three years, etc).

For comparison, a policy from Zurich with a payout of 60,000,000 JPY and similar conditions is 14,940 JPY. I should note, however, this is a LEVEL term policy. So whether I die one day after concluding the contract (cancer withstanding), or one day before it expires, my beneficiary would receive the whole amount.

This leads me to a much bigger--albeit tangential question--if you or any other community member can enlighten me:

I hear it often said that the Japanese are over-insured. But how can that be when the majority of advertised level term life policies are in the 20M range? In the US (where I am from), 50M plans seem fairly common, and for my age, go for less than $40 USD per month--that is almost ONE-FOURTH the price of a policy in Japan!

Do not worry, dear members, I known very well that this is Japan; and that I either accept it, or get out of the way of customers willing to pay. I just cannot help but feel that I am missing something...

EJDT

Excellent suggestion. Unfortunately, FWD Japan's website does not have a premium simulator for term life insurance (nor any other life insurance policy for that matter): https://direct.fwdlife.co.jp/fli_front/ ... 6279729358.

The monthly premium is: 6,506 JPY.

For your reference, I am a healthy (good 健康診断書, which must be submitted) 39 year-old non-smoker. The policy would last until I am 65.

Without inundating you with too much detail, the policy includes payout even if I die from the "Big 3" (3大疾病). The remaining conditions are pretty standard (ie, I cannot die from cancer in the first 90 days, my dependents cannot claim if I commit suicide in the first three years, etc).

For comparison, a policy from Zurich with a payout of 60,000,000 JPY and similar conditions is 14,940 JPY. I should note, however, this is a LEVEL term policy. So whether I die one day after concluding the contract (cancer withstanding), or one day before it expires, my beneficiary would receive the whole amount.

This leads me to a much bigger--albeit tangential question--if you or any other community member can enlighten me:

I hear it often said that the Japanese are over-insured. But how can that be when the majority of advertised level term life policies are in the 20M range? In the US (where I am from), 50M plans seem fairly common, and for my age, go for less than $40 USD per month--that is almost ONE-FOURTH the price of a policy in Japan!

Do not worry, dear members, I known very well that this is Japan; and that I either accept it, or get out of the way of customers willing to pay. I just cannot help but feel that I am missing something...

EJDT

-

captainspoke

- Sensei

- Posts: 1573

- Joined: Tue Aug 15, 2017 9:44 am

Re: FWD Insurance (for term life insurance)

Even if...?!

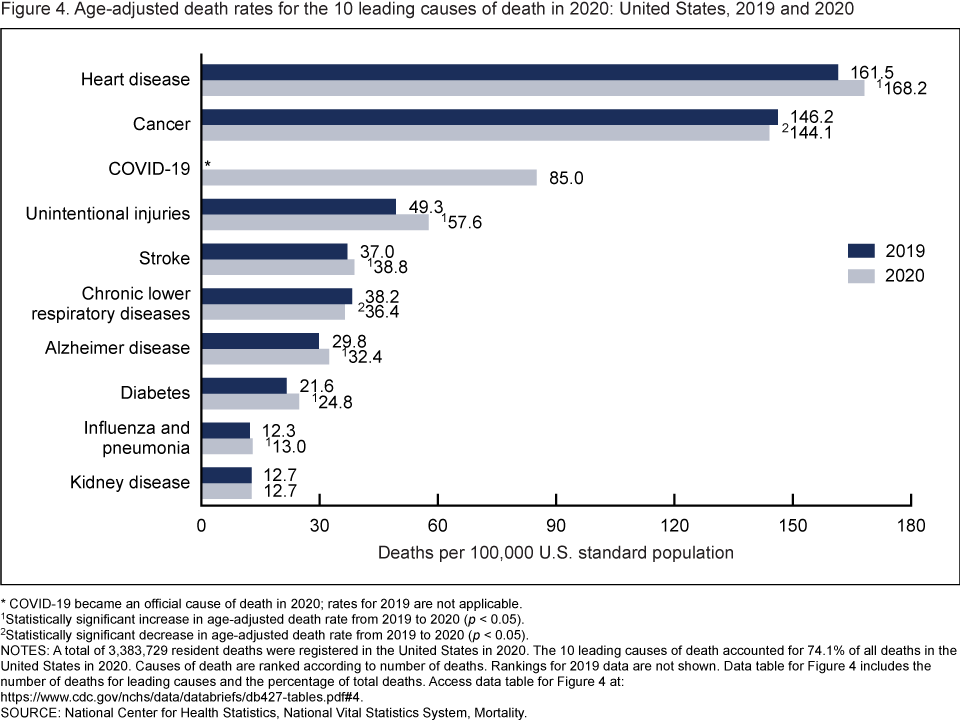

Statistically, cancer and heart disease are at the top, stroke is down a little. If those weren't covered, would that kind of life insurance be worth buying? Why buy a policy that wouldn't cover the most likely causes of death?

A chart from googling:

-

TBS

Re: FWD Insurance (for term life insurance)

That FWD premium does look attractive. What does the payout taper look like? Does it decrease linearly from 90 to 7 million over the 25 years? Can you confirm if you are male? (looks like you could be from the Zurich premium you quoted...)EJDT wrote: ↑Thu Mar 03, 2022 4:18 am Excellent suggestion. Unfortunately, FWD Japan's website does not have a premium simulator for term life insurance (nor any other life insurance policy for that matter): https://direct.fwdlife.co.jp/fli_front/ ... 6279729358.

The monthly premium is: 6,506 JPY.

For your reference, I am a healthy (good 健康診断書, which must be submitted) 39 year-old non-smoker. The policy would last until I am 65.

Without inundating you with too much detail, the policy includes payout even if I die from the "Big 3" (3大疾病). The remaining conditions are pretty standard (ie, I cannot die from cancer in the first 90 days, my dependents cannot claim if I commit suicide in the first three years, etc).

For comparison, a policy from Zurich with a payout of 60,000,000 JPY and similar conditions is 14,940 JPY. I should note, however, this is a LEVEL term policy. So whether I die one day after concluding the contract (cancer withstanding), or one day before it expires, my beneficiary would receive the whole amount.

I guess the price difference to the US will be related to the underlying investments the insurers are using. This is an interesting paper on the topic: https://www.boj.or.jp/en/research/wps_r ... v17e02.pdfEJDT wrote: ↑Thu Mar 03, 2022 4:18 am This leads me to a much bigger--albeit tangential question--if you or any other community member can enlighten me:

I hear it often said that the Japanese are over-insured. But how can that be when the majority of advertised level term life policies are in the 20M range? In the US (where I am from), 50M plans seem fairly common, and for my age, go for less than $40 USD per month--that is almost ONE-FOURTH the price of a policy in Japan!

Do not worry, dear members, I known very well that this is Japan; and that I either accept it, or get out of the way of customers willing to pay. I just cannot help but feel that I am missing something...

Charts 3-5 show the Japanese insurers are heavy on JP government bonds (low returns), whereas US insurers invest mainly in equities and corporate bonds (higher returns). This will allow them to charge lower premiums. Potentially FWD are using higher expected return investments compared to other Japanese insurers.

Note direct comparison is also not straightforward because $500,000 in 20 years time to an American is expected to be worth less in real terms than 50M yen in 20 years time to a JP resident, because of differences in inflation. That said the premiums in later years will be cheaper in real terms to the American, and this inflation effect also decreases the "real-terms coverage" over time which can be a good thing, as you say.

Yes it is often said Japanese are over-insured, but more often in the context of supplementary health insurance, mobile phone insurance, that kind of thing. Lower median income, cost of living and healthcare in Japan will partly explain why advertised coverage levels can be lower in Japan than the US.