For example, some sites say that by the time you are 30, you should have around half your annual salary as your net worth. At 40, you should have double your annual salary. 4 times your annual salary by the time you are 50 and 6 times your annual salary by 60.

A quick check on average salaries in Japan by age gave me this: (It's 5 years old, but just using as a rough guidance)

By this graph this would total to: (roughly using overall average)

Age 30 - $20,000 or JPY 2,000,000

Age 40 - $95,000 or JPY 9,500,000

Age 50 - $225,000 or JPY 22,500,000

Age 60 - $420,000 or JPY 42,000,000

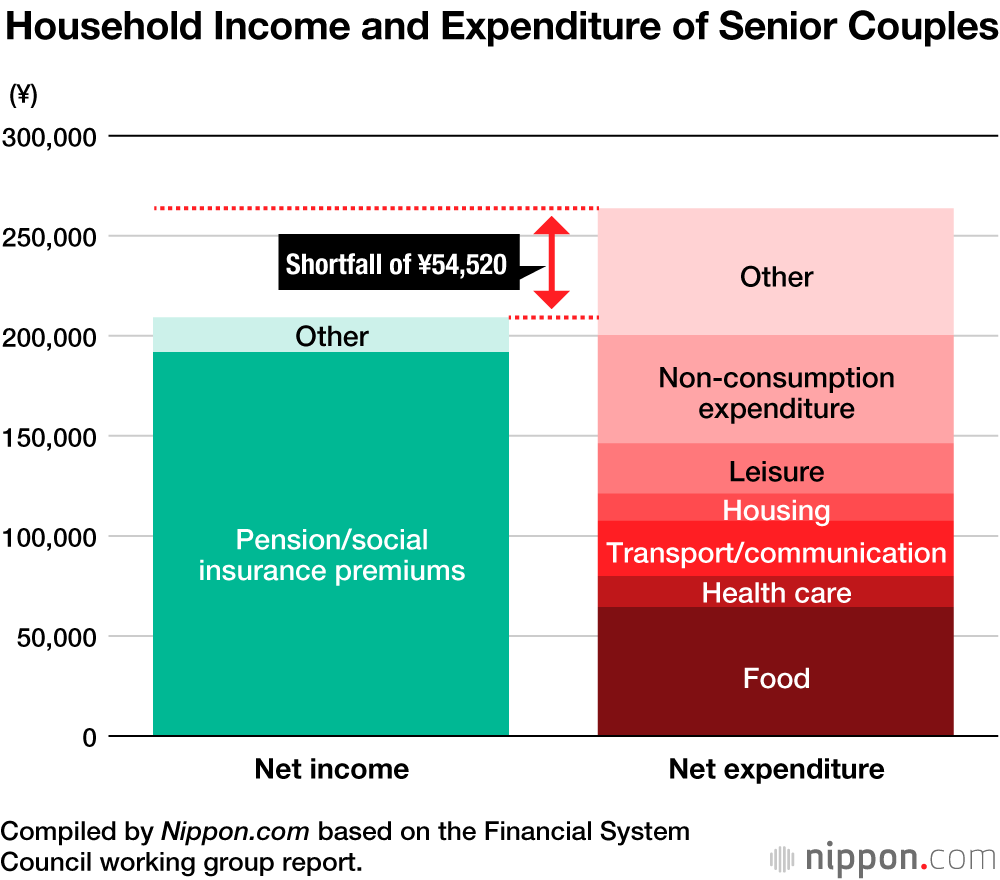

Of course, the amount of money you need when you retire depends on your annual expense etc. and there are rules that you should have approximately 20 times your annual expense as your net worth etc.

What do you guys think?

Are these numbers applicable to Japan?

What are the benchmarks you guys follow?

Do you have targets by Age? Are they similar to the above? Higher? Lower?