Hmmm,ivanpgs wrote: ↑Tue Feb 23, 2021 3:57 am Even starting off with Tsumitate NISA you can change your plan to NISA, then rollover to New NISA and then get back to Tsumitate NISA (that has been recently extended 5 years to 2042 from the previous 2037, although the maximum you can get free tax is 20 years).

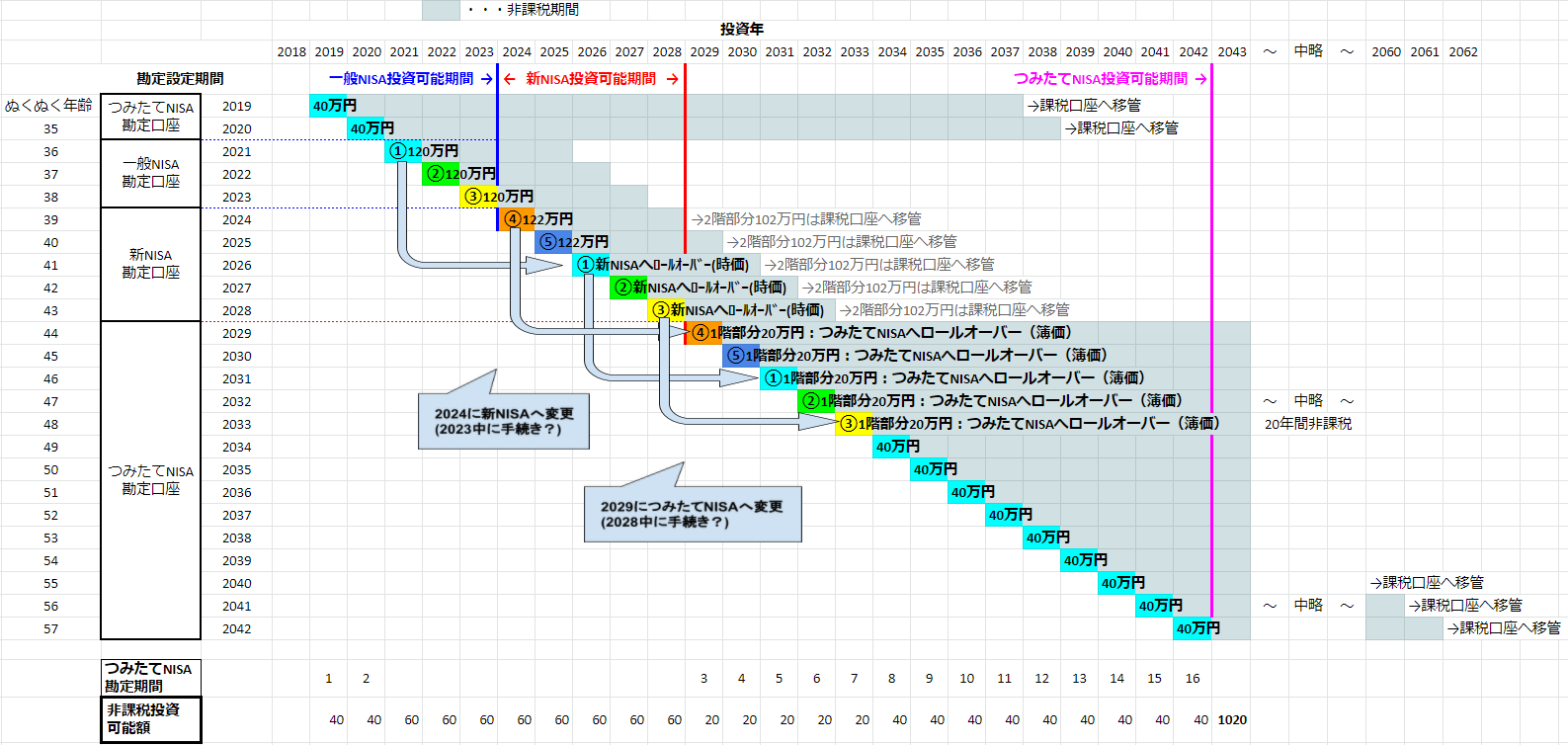

This guy started with Tsumitate NISA in 2019 (with SBI), then applied for a transfer to NISA plan in 2021 (he did it in advance applying in October so that he can start it in 2021). The whole plan to max out everything is as follows:

And the whole interesting article is here: https://nukunukusas.com/tsumitatenisa-to-nisa.

And the calculations with all of these plans mixed together go from the 8M Yens allowed during 20 years of Tsumitate NISA to 11.64M. Not a bad deal! Still I am wondering how all of these different NISA plans would work when it comes to tax free reporting (I guess everything would be done by the NISA provider anyway).

As for me, I also started the same way with Tsumitate NISA but in 2018 with SBI, then transfer to Rakuten in 2020 (unfortunately the first 2 years of 400K free tax were lost, as you the former provider will sell off all of it before the account is transferred to the new provider...). So here I am, in my second year of Tsumitate NISA with Rakuten (2020 and 2021), but the fourth of my 20 free tax years in Tsumitate NISA. I need to come up with a plan like the one on the blog.

I should have tried to investigate a bit more in advance but the language barrier did not let me get deeper on the plan. Well, it's never too late!

The more I read the more confused I get. It seems that even the guy that wrote the article above which plan is doing the following:

Tsumitate NISA ---(transfer, 区分変更)---> Regular NISA ---(rollover, ロールオーバー)---> New NISA ---(transfer, 区分変更)---> Tsumitate NISA (resuming the original Tsumitate NISA)

He does not seem to be 100% sure that he will be able to resume on the first original Tsumitate NISA.

I read other article (below) in which the writer warns about the same thing:In the last line he said that if he might not be able to transfer / rollover from the NEW NISA back to the Tsumitate (さらには、新NISAからつみたてNISAへロールオーバーできる予定です。しかし、ロールオーバー先の勘定口座で取り扱いの無い銘柄だとロールオーバーできません。).

Whole article: https://fpsdn.net/fp/rnohara/column/1041

Which again I might misunderstand, but it seems to me that if you switch from NISA to Tsumitate NISA or viceversa, then your new investments for the original NISA account will be done on a non free-tax account instead of resuming on where you left before transferring to the other NISA type. While this might be no problem if you do the following:2. 再投資型投資信託の再投資分の取扱いに注意!

区分変更(一般NISA→つみたてNISA、つみたてNISA→一般NISA)すると、

再投資型投資信託の再投資分は、従来は非課税枠内では可能であったNISA口座での再投資ではなく、

課税口座(一般口座か特定口座)にて再投資されますのでご注意ください。

Regular NISA ---(rollover, ロールオーバー)---> New NISA ---(transfer, 区分変更)---> Tsumitate NISA

It might be a problem if you try to do like this (which is my case):

Tsumitate NISA ---(transfer, 区分変更)---> Regular NISA ---(rollover, ロールオーバー)---> New NISA ---(transfer, 区分変更)---> Tsumitate NISA

Which is the same as the pic I shared below:

But what interpreted after reading this "fpsdn.net" article is that the original Tsumitate NISA investments might be transferred to a non free-tax account, not being able to resume on those investments after going through the Regular NISA ---(rollover, ロールオーバー)---> New NISA steps.

This is getting complex, so I might continue with my current approach of maxing out my Tsumitate NISA and, perhaps starting to use a Tokutei account to increase the amount of investments.

Any thoughts?